NZD/USD made a move higher and reached the highest levels in 6 months. Nevertheless, new worries, especially from China, depressed it once again. Inflation data is the highlight of this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD.

New Zealand’s private sector businesses increased their confidence in the first quarter with a rise to 13 from a flat reading in the last quarter of 2011. However the survey also reveals manufacturing exports is expected to remain flat in the first quarter, indicating the recovery is still fragile. Will the positive sentiment continue in the next quarter?

Updates: HPI jumped 1.9%, the best reading since March 2011. The Food Price Index dropped by 1.%, the first contraction by the index since November 2011. NZD/USD is sliding, as the pair fell below the 0.82 level, and is trading at 0.8188. The pair is holding steady, trading just under the 0.82 level, at 0.8197. The markets are waiting for the release of CPI, which is released quarterly, on Wednesday. The market forecast calls for a 0.6%, after the previous reading posted a drop of -0.3%. NZD/USD is lower, as the pair has fallen below the 0.82 level, and is trading at 0.8171. The highly anticipated CPI figures did not cause any surprises or shocks. The quarterly release came in at 0.5%, just below the market forecast of 0.6%. This was a marked improvement from the 2011 Q4 reading, where the inflation index posted a drop of -0.3%.

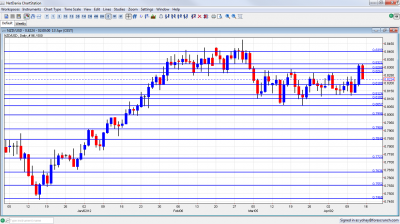

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- FPI: Sunday, 22:45. The food price index increased 0.6% in February, 1.5% higher than the same month a year earlier. Inflation is expected to remain within the comfort zone of the RBNZ’s target band through most of 2012.

- Inflation data: Wednesday, 22:45. Consumer price index deflated 0.3% in the fourth quarter of 2011. This was the first negative inflation figure in two years beating expectations for 0.4% increase. The major declines occurred at food, communication while transport and health prices increased. A rise of 0.6% is expected this time.

- IMF Meetings: Fri.-Sat. IMF-World Bank invites major bankers and government officials for its Spring meeting , 20-22 in April2012 in Washington DC. At the heart of the gathering are meetings of the joint World Bank-IMF Development Committee and the IMF’s International Monetary and Financial Committee, which discuss progress on the work of the World Bank and IMF.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/$ kicked off the week with a small rise, but then fell to the 0.8124 line mentioned last week. From there it made a strong move higher and reached 0.8320 before losing ground and closing at 0.8224.

Technical lines, from top to bottom:

0.8573 was a stubborn line of resistance during August 2011 and remains of high importance. 0.8505 was a peak on the way up during July. A move higher in February 2012 fell short of this line.

The 0.84 line separated ranges in August 2011, and earlier served as support when the kiwi traded higher. While this line was hurt recently, it still serves as a serious cap. 0.8320 capped an attempt for a surge in April 2012 and is now of stronger importance.

0.8290 capped the pair in a stubborn manner during March 2012, and set the pair falling. 0.8264 capped the pair as a double top in both March and April 2012 and proved to be quite strong.

0.8190 is the next line. It capped the pair in March 2012 and also provided some support in January. The round number of 81 worked as support in February 2012 and also later on. 0.8124 worked as a significant cushion during April 2012 and also beforehand and is now strong support.

0.8060 was resistance in October and support beforehand.. It was also tested in January and in March, this time as support and provided to be very strong. The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance.

Another round number, 0.79, is now stronger resistance after capping a rise at the beginning of 2012. 0.7840 worked as cap for a range and earlier stopped the pair in October. It then became much stronger in December, holding the range. The pair approached in the last days of 2011, but couldn’t really challenge it.

0.7773 was the bottom border of a range at the beginning of 2012, and also in December. 0.77 provided support in December and is now minor support. 0.7637 was a swing low in September and provided its strength in December as a swing low. It is a still strong, after capping a recovery attempt in December.

0.7550 now has a stronger role after working as a very distinct line separating ranges. It had a similar role back in January.

I am bearish on NZD/USD

The slower growth in China will remain a main feature weighing on the kiwi. In addition, the softer US figures can now turn in favor of the greenback, as the risk averse atmosphere returns.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.