The kiwi slid as prospects of QE3 in the US were on the retreat – no fuel for commodities weakens the New Zealand dollar. NZIER Business Confidence is the main event this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD.

NZD/USD did manage to recover some of its losses thanks to another US event: Non-Farm Payrolls were a big disappointment, that raised the prospects of QE3 once again.

Updates:NZD/USD is steady, trading at 0.8194. The markets are waiting for the release of Business Confidence later this week, the first economic indicator to be released this week. NZD/USD is slightly lower, trading at 0.8169. The quarterly Business Confidence indicator came in at 13, an impressive rise after a flat reading of zero in March. However, the reading is well below the figures for Q2 and Q3 of 2011, which were 25 and 27, respectively. NZD/USD is steady, trading at 0.8184. Business NZ Manufacturing Index disappointed, dropping to 54.5. This was a considerable drop from last month’s reading of 57.7. The kiwi rallied, as NZD/USD climbed above the 0.82 level, trading at 82.13.

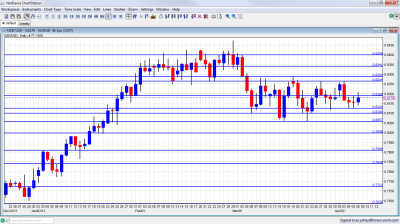

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- NZIER Business Confidence: Wed. – Thu.New Zealand private sector business confidence plunged in the fourth quarter. 0.0% of companies surveyed expect business conditions to improve or worsen over the next six months following 25% that expected general conditions to improve in the previous quarter.New Zealand’s domestic market activity has been slightly affected by the European crisis but global conditions are weighing on NZ business confidence.

- REINZ HPI : Wed.-Tue. REINZ Housing Price Index increased 0.8% in February after the 1.4% drop in January. A shortage of new houses over recent years together with the earthquakes damage resulted in a very tight housing market inAuckland andCanterbury contributing to the rise in prices.

- Business NZ Manufacturing Index: Wednesday, 22:30.New Zealand’s manufacturing activity surged in February rising to 57.7 from50.8 in January. This strong reading does not signify a real change since the manufacturing scale was very limited in recent years.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/$ started the week with a second challenge of the 0.8264 line (which didn’t appear last week). It then changed direction, found support at 0.8124 before failing to conquer 0.8190.

Technical lines, from top to bottom:

0.8573 was a stubborn line of resistance during August 2011 and remains of high importance. 0.8505 was a peak on the way up during July. A move higher in February 2012 fell short of this line.

The 0.84 line separated ranges in August 2011, and earlier served as support when the kiwi traded higher. While this line was hurt recently, it still serves as a serious cap. 0.8340 was a peak in September and now returns to support. It was a tough line of struggle in February 2012.

0.8290 capped the pair in a stubborn manner during March 2012, and set the pair falling. 0.8264 capped the pair as a double top in both March and April 2012 and proved to be quite strong.

0.8190 is the next line. It capped the pair in March 2012 and also provided some support in January. The round number of 81 worked as support in February 2012 and also later on. 0.8124 worked as a significant cushion during April 2012 and also beforehand and is now strong support.

0.8060 was resistance in October and support beforehand.. It was also tested in January and in March, this time as support and provided to be very strong. The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance.

Another round number, 0.79, is now stronger resistance after capping a rise at the beginning of 2012. 0.7840 worked as cap for a range and earlier stopped the pair in October. It then became much stronger in December, holding the range. The pair approached in the last days of 2011, but couldn’t really challenge it.

0.7773 was the bottom border of a range at the beginning of 2012, and also in December. 0.77 provided support in December and is now minor support. 0.7637 was a swing low in September and provided its strength in December as a swing low. It is a still strong, after capping a recovery attempt in December.

0.7550 now has a stronger role after working as a very distinct line separating ranges. It had a similar role back in January.

I remain bearish on NZD/USD

While the US isn’t at its best after the soft NFP, the “risk currencies” aren’t doing so well either. With China wallowing in the mire, the New Zealand dollar has more room for drops.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.