The ECB meeting are held in Barcelona, under heavy security. Mario Draghi and his colleagues aren’t expected to change the interest rates nor announce another LTRO.

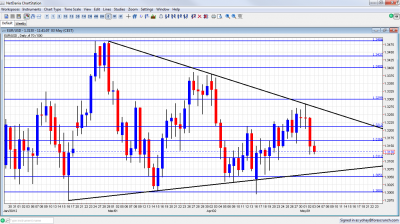

But hinting about future plans is certainly possible. EUR/USD is in the middle of the narrowing channel after a failed attempt to break higher. Will it break lower? Follow the live blog of the ECB Press Conference

The recent PMI data shows a deeper recession that is already reaching the core. The jump in German unemployment isn’t usually seen and it’s another warning sign. Spain, which hosts the ECB meeting has an unemployment rate of nearly 25%.

Spanish banks bought a lot of Spanish bonds due to the ECB’s LTRO, and as bond prices rise (yields rise), they aren’t enjoying the arbitrage but rather suffering losses. A fresh auction resulted in higher yields once again.

Another reason for getting something from the ECB is the recent ECB bank lending survey that was weak due to weak demand.

As the ECB usually provides hints to the markets about the next moves, a rate cut isn’t likely, but a hint is certainly on the cards.

EUR/USD has been falling this week after challenging downtrend resistance. It is now below the middle of the channel at 1.3128. The limits as of today are 1.3060 and 1.3275.

For more on the pair, see the euro to dollar forecast. The announcement is at 11:45 GMT and the press conference is planned for 12:30.