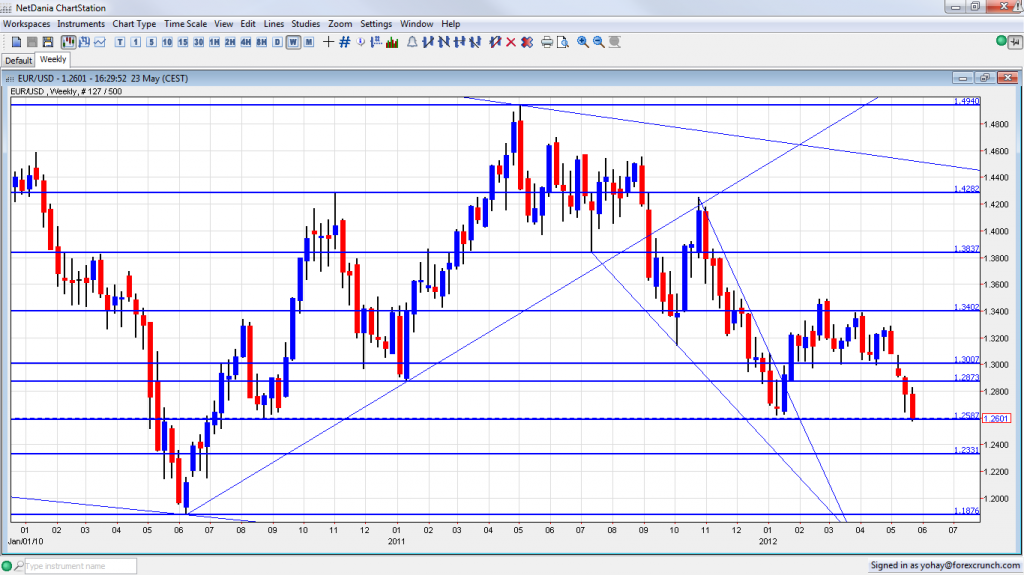

EUR/USD is diving to fresh 21 month lows after the US New Home Sales exceeded expectations. This was just the camel that broke the camel’s back. An earlier dip, following comments regarding a euro exit ended in a short lived recovery. The weekly chart provides the big picture for this dive:

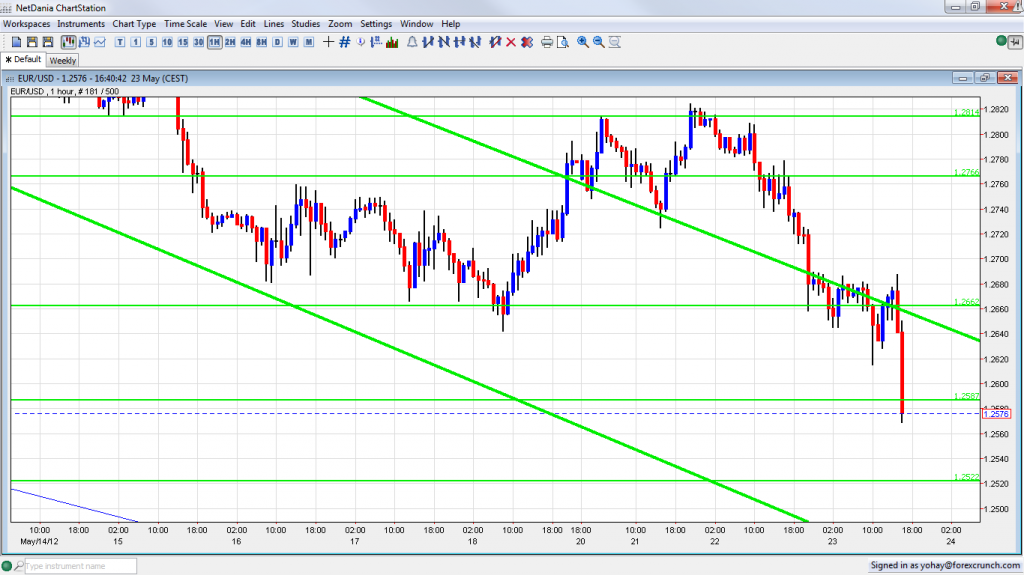

We now have the full move. The pair managed to dip below another support line but yet again, this initial dip was followed by a rebound.

1.2587 was the low recorded in August 2010. The lowest since then was 1.2624 at the beginning of the year. Greece’s former Prime Minister Lucas Papademos was “responsible” for a dip late yesterday when he said that contingency plans for a Greek exit are probably in the works.

See how to trade the Grexit with EUR/USD.

His words were interpreted as saying that he knows of such plans. He later clarified it, but in the meantime the drop continued. EUR/USD reached 1.2615 and saw a rebound.

In addition, the EU Summit doesn’t look very promising: France and other countries want eurobonds, while Germany strictly refuses. In any case, this is not the magic solution to all the problems.

US New Home Sales surprised with a small rise from 332K (an upwards revision from the initial report of 328K) to 343K. An annual level of 335K was expected. Also previous months were revised. This goes hand in hand with the improvement in the more important existing home sales, which gave the sense that US housing reached a bottom.

This was the trigger to the fall. During the writing of the article, the pair continues deeper, moving below the 1.2587 line to 1.2570. The next support is at 1.2520, but it’s not that strong.

This is how it looks on the daily chart:

On the downside, also 1.24 is worth mentioning before the historic line of 1.2330. 1.2587 is resistance followed by 1.2623.

For more, see the EUR/USD forecast.

The euro isn’t alone in this fall. Other currencies are following. Stay tuned for updates.