The Canadian dollar continued its retreat against the greenback, but USD/CAD didn’t cross critical resistance so far. Will it stabilize here? Gross Domestic Product is the highlight of this week. Here’s an outlook for the Canadian events and an updated technical analysis for USD/CAD.

Last week Core retail sales for March were weaker than expected rising 0.1% after a 0.8% decline in February bur lower than the 0.5% rise anticipated by economists while Retail sales grew in line with predictions rising 0.4% after a 0.2% fall in February. Although the rise in Core sales is not in line with predictions the overall figure suggest improvement from February.

Updates: Friday’s Core CPI looked sharp, rising 0.4%. This exceeded the market estimate, which stood at 0.2%. CPI also rose 0.4%, beating the market forecast of 0.3%. USD/CAD, which broke through the 1.03 line on Friday, retraced, and was trading at 1.0228. The markets are waiting for the release of RMPI on Wednesday. The manufacturing index contracted in April , but the markets are forecasting a much rosier May, with an estimate of 2.1%. USD/CAD is unchanged, and was trading at 1.0237. The loonie continues to lose ground against its US counterpart, as the greenback is performing well against the major currencies. USD/CAD was trading at 1.0286. The markets are waiting for the release of RPMI and IPPI on Wednesday. RPMI declined by 2.0%, well below the -1.1% estimate, and a four-month low. IPPI came in at a flat 0.0%, a notch under the 0.1% forecast. Current Account will be released later on Thursday. USD/CAD was unchanged, trading at 1.2073.

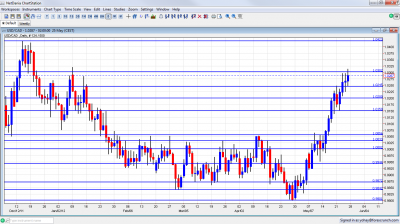

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- RMPI: Wednesday, 12:30. Raw Materials Price Index dropped 1.6% in March, following 0.6% decline in February. The Decrease was led by mineral fuels and crude petroleum while the main contributors were grain prices. Economists expected a 0.4% increase. Meantime, The Industrial Product Price Index (IPPI) edged up 0.2% in March, due to price increase of petroleum and coal products. This increase was preceded by a 0.3% gain in February. Raw Materials Price Index is predicted to gain 2.1% while IPPI is predicted to rise 0.1%.

- Current Account: Thursday, 12:30.Canada’s current-account deficit narrowed to $10.3 billion in the fourth-quarter of 2011 due to a $3.1billion merchandise trade surplus indicating an improvement in market activity and increased exports to the US. Analysts expected deficit to shrink even further to % 9.4 billion. An increase in deficit to $11.1 billion is predicted now.

- GDP: Friday, 12:30.Canada’s economy contracted unexpectedly in February dropping 0.2% contrary to analysts’ predictions of 0.2% expansion and following 0.1% gain in the previous month. This surprising decline will have a negative affect on the first quarter growth rate and delay possible rate hikes in the near future. A growth rate of 0.3% is anticipated this time.

* All times are GMT.

USD/CAD Technical Analysis

A first attempt by Dollar/CAD to move higher didn’t succeed, and the pair dropped. A second move was already more successful, but the pair couldn’t cross the critical 1.03 line (mentioned last week).

Technical lines, from top to bottom:

We move higher once again. 1.0850 was last seen in 2010, but has been very persistent as a cap for the loonie. 1.0750 was the peak of ranges several times in the past few years, and is a very important line.

1.0660 was last seen in September 2011, but this line was also a long running swing high several times beforehand. 1.0523 was a peak back in November and is minor resistance.

1.0423 is the high line that capped the pair towards the end of 2011 and remains far in the distance. The round number of 1.03 was resistance at the beginning of the year and wasn’t challenged again in May 2012.

1.0245 served as a separator for the move up when the pair rallied in May 2010. The round figure of 1.02 was a cushion when the pair dropped in November, and also the 2009 trough. It is weaker now but remains pivotal after being broken.

1.0150 was a swing low in September and worked as resistance several times afterwards. 1.0050 was tough resistance in April 2012 and also in May.

Very close by, 1.0030 capped the pair twice in March 2012 but is weaker now after working only temporarily in May. The very round number of USD/CAD parity is a clear line of course, and the battle is renewed after the recent climb.

Under parity, we meet another pivotal line at 0.9950. It served as a top border to range trading in March 2012 and later as a line in the middle of the range.

0.99, the round number is now present on the graph after capping the pair in May 2012. 0.9840 provided support for the pair during September and was reduced to a minor line now.

I remain neutral on USD/CAD.

The US dollar and the yen certainly dominated the charts in the past weeks, but this could stabilize now. Even if some currencies continue losing against the dollar, the C$ could still be OK, thanks to domestic strength. This is relevant unless Spain and Greece deliver even worse news, something that can’t be excluded. GDP will be a significant test.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand Dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast