The New Zealand dollar certainly benefited from the relative calm in the markets. This will probably not last in week that starts with the Greek elections. In New Zealand, the Current Account and the GDP figures are the highlights of this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD.

Last week Alan Bollard Governor of the RBNZ reported to the Parliament’s Finance Select Committee about the central bank’s monetary policy decision to maintained rates. The decision was made in light of the modest economic growth rate and downside risks such as the euro zone debt crisis, the economic slowdown in China and the sharp rise in Government debt. Will NZ succeed to avoid the effect of external risks?

Updates: Consumer Sentiment fell below the 100 point level for the first time since March 2011. The indicator declined to 99.9, indicating that consumer confidence in the New Zealand economy is dropping. Current Account, a key release, will be published on Tuesday. NZD/USD is steady, trading at 0.79.14. The kiwi continues to impress, having gained around four cents in June. NZD/USD was trading at 0.7946. Current Account improved from the previous reading, but the deficit was still larger than the market forecast. The indicator came in at -1.31 billion, worse than the estimate of -1.13B. NZD/USD was up slightly, as the pair was trading at 0.7969. GDP sparkled, with its best monthly performance in over five years. The indicator shot up 1.4%, easily exceeding the market estimate of 0.5%. The kiwi continues to edge towards the 80 level as NZD/USD was trading at 0.7982. Visitor Arrivals will be released later on Thursday.

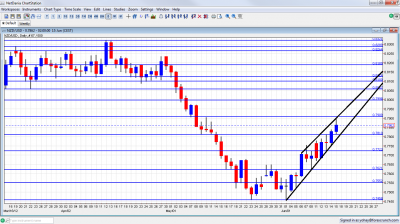

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Greek elections: Sunday, initial results expected before markets open and the impact is set to last for a long time. The kiwi is expected to mirror the euro, at least at the beginning of the week, depending on the outcome: a pro-bailout victory(NZD/USD rises at first), an anti-bailout victory (NZD/USD falls at first) or a hung parliament (NZD/USD falls slowly). The moves in this pair could be sharper than in the euro. See details here: how to trade the Greek elections

- Westpac Consumer Sentiment: Sunday, 22:00.New Zealand consumer confidence survey results remained soft in the first quarter rising to 102.4 after101.3 in the fourth quarter of 2011 raising concerns over the strength of the economy and inflation pressures. Subdues confidence means less consumer spending and lower growth for NZ economy in early 2012.

- G20 Meetings: Mon-Tue. The next G20 meeting will be held in Los Cabos,Mexico where finance ministers and central bank governors coming from 19 states will discuss global issues. However the central theme of this meeting will be the European debt crisis. The meeting starts a day after Greek elections which could decide whether the country stays in the euro zone.Brazil conditions its monetary contribution to the IMF Funding on having more power at the IMF. Voting power at the IMF is currently dominated by the United States and other developed powers.

- Current Account: Tuesday, 22:45.New Zealand’s current-account deficit narrowed in the fourth quarter of 2011 amid a boost in dairy exports. Deficit shrank to $NZ2.763 billion from a revised $NZ4.751billion in the previous quarter. Economists expected a higher deficit of $NZ2.825 billion. Another reduction in deficit to $NZ 1.16 is predicted now.

- GDP: Wednesday, 22:45.New Zealand’s economy expanded by 0.3% in the fourth quarter of 2011 amid stronger growth in the financial services and agriculture sectors overpowering declines in manufacturing and government administration. However, economists predicted a 0.6% growth rate suggesting the Reserve Bank will maintain the Official Cash Rate on hold until December this year.0.4%

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/$ dollar began the week with a small gap, but fell to uptrend support before stabilizing in a range under the 0.7810 line (mentioned last week). It then moved forward, and was capped by the 0.79 before closing lower, at 0.7862.

Technical lines, from top to bottom:

We begin from a higher ground this time: 0.84 was resistance back in February 2012. 0.8320 was a wing high in April, just before the big fall.

0.8260 capped the pair during March, and is stubborn resistance. 0.8185 was resistance in the past and is now weaker.

The 0.8080-0.81 region supported the pair during March and April and will be a tough barrier if 0.80 is broken. 0.8060 was resistance in October and support beforehand. It was also tested in January and in March, is much weaker now after only temporarily stopping the fall.

The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance. Another round number, 0.79, is key resistance, after being a very distinct line separating ranges. It proved its strength also in June 2012.

0.7810 was a double bottom in May 2012 and also served as resistance at the end of 2011, and now returns to this role after the crash.

0.7723 supported the pair back at the beginning of 2012 and also worked in the other direction in June 2012. 0.77 provided support in December and now switches to support.

0.7620 provided support in May 2012 and is resistance once again, although weaker than in previous weeks. 0.7550 is resistance once again, even after the breakdown. It was a very distinct line separating ranges and had a similar role back in January.

Below, 0.7460 is significant support after working as support at the end of 2011 and also in May and June 2012. This is key support. 0.7370, which was the trough in December is low support. This is a significant line if 0.7460 breaks.

0.7308 is minor support after working as such at the beginning of 2011. 0.72 worked in both directions during the past few years.

0.71 is the last line, after being a distinct trough in March 2011.

Steep Upward Channel

As you can see in the graph, the pair is rising in a steep channel. Uptrend support is clearer than uptrend resistance.

I am bearish on NZD/USD

With no QE3 in the pipeline, a potential disappointment from GDP and the looming Greek elections, the pair might suffer as a “risk currency”. Central bank intervention or a better than expected GDP could change the picture.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.

- For the Swiss Franc, see the USD/CHF forecast.