USD/JPY eventually slid a bit lower, as the pair remained surprisingly stable in the global storm. Current Account and rate decision are the major events this week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

The mediocre US Non-Farm Payrolls figure hurt the dollar against the yen, but the effect was not strong, as the weak figures are not enough for QE3. Last week Tankan business-sentiment survey improved unexpectedly, rising well above expectations. Major companies’ sentiment improved to -1 after two quarters of a -4 result and major non-manufacturing firms reported a climb to 8 from 5 the previous quarter. These encouraging figures suggest improvement in Japan’s economic activity in the coming months.

Updates: Bank Lending was up in the July reading, climbing 0.7%. The indicator had increased by 0.3% over the past two readings. M2 Money Stock will be released later on Monday. USD/JPY continues to be marked by narrow range trading, as the pair was trading at 79.59. M2 Money Stock posted a 0.2% increase, matching the market estimate. As expected, Household Confidence was almost unchanged, recording a reading of 40.4 points. USD/JPY was trading at 79.47. Tertiary Industry Activity surprised the markets with a 0.7% gain. The market estimate stood at 0.2%. CGPI disappointed, dropping by 1.3%. This was the weakest reading in over two years. The volatile Preliminary Machine Tool Orders posted a second straight contraction. The June reading plummeted by 15.5%, the steepest slide since November 2009. The yen edged upwards, as USD/JPY dropped to 0.7925. As expected the BOJ maintained its benchmark interest rate at 0%-0.25%. The central bank followed the announcement with a Monetary Policy Statement and a press conference. USD/JPY was steady, trading at 79.32.

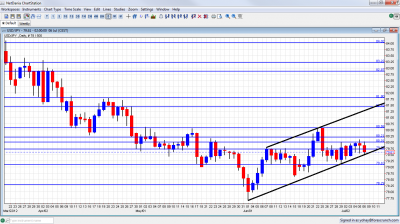

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- Japan Current Account: Sunday, 23:50. The Japanese Adjusted Current Account index narrowed its surplus to 0.29T in April, following a surplus of 0.79T in March. Economists expected a larger surplus of 0.62T. Overseas trade is getting weaker day by day, badly affecting Japan’s trade balance surplus and GDP growth. However domestic demand is getting stronger providing a modest contribution to Japan’s economic growth. An increase to 0.42T is expected now.

- Core Machinery Orders: Sunday, 23:50. Core Machinery Orders: edged up 5.7% in April from compared to a 2.8% dip in March. The rise was well above the 2.0% increase predicted by analysts indicating a recovery trend spurred by the post- earthquake reconstruction activity A drop of 2.4% is anticipated now.

- Economy Watchers Sentiment: Monday, 5:00. Japan’s service sector sentiment dropped to47.2 in May, following50.9 in April caused by the strong yen and Europe’s debt crisis suggesting economy’s pickup is moderating. A slight increase to 47.6 is likely.

- Household Confidence: Tuesday, 5:00. Japan’s consumer confidence index edged up to the highest level in 15 months in May, reaching 40.7 from40.0 in April amid improvement in employment and economic conditions. Another rise to 40.9 is expected this time.

- Tertiary Industry Activity: Tuesday, 23:50. Japan’s service sector unexpectedly contracted in April by 0.3% following 0.6% drop in March. The main contributors for this decline were transport, electricity and miscellaneous services. Economists expect Tertiary activity could weaken further in the coming months. An expansion of 0.2% is anticipated now.

- Rate decision: Thursday. The Bank of Japan maintained its monetary policy refraining from additional easing measures, keeping its options open in case of further deterioration in the European debt crisis. Overnight call loan rate was kept in a 0.0%-0.1% range and the asset-purchase program was also maintained. O change in policy is predicted.

* All times are GMT.

USD/JPY Technical Analysis

$/yen began the week with a small drop, and later recovered and reconquered the 80 line (discussed last week) for some time. This didn’t last and the pair eventually closed at 79.61.

Technical lines from top to bottom

84 was the peak reached in March and remains a tough spot. 83.20 provided support when the pair traded on high ground and it then switched to resistance.

82.87 is a veteran line – that’s where the BOJ intervened for the first time back in 2010. 81.80 capped the pair in April.

81.43 is stronger after serving as resistance for a recovery attempt. 80.60 provided support for the pair around the same time, and served as a bouncing spot for the next moves. It proved its strength as resistance in June 2012, more than once.

80.20 separated ranges in May 2012 and remains another barrier after 80 on the upside. The round number of 80 is psychologically important, even though it was crossed several times in recent months. It is stronger now.

79.70 was a cap was seen in June 2012. 79.10 was a cushion for the pair several times in June and also back in May 2012.

78.30 capped a second recovery attempt in November, after the intervention and had an important role earlier as well, working as support. This is a key line after the fall.

77.50 was the bottom border of a range the pair had at the end of 2011. It is followed by 77, which is only minor support.

76.60 was a cushion for the pair at the beginning of the year and is rather strong. 76.26 is the next line on the downside after working as a support quite some time ago.

Uptrend channel

Since the beginning of June, the pair has been trading in an uptrend channel. Note that uptrend support is more significant than uptrend resistance, and that the pair is close to support at the moment.

I am neutral on USD/JPY.

In the long run, the pair has room for rises. However, the global gloom, ranging from Europe to China, increases yen flows. While QE3 has a low chance, this continues to weigh on the pair, especially after the unexciting NFP.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand Dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast

- For the Swiss Franc, see the USD/CHF forecast.