NZD/USD moved higher but was unable to challenge the highs it reached earlier in the month. NBNZ Business Confidence is the highlight of this week. Here’s an outlook for the events in New Zealand, and an updated technical analysis for NZD/USD.

The New Zealand dollar enjoyed new hope for dollar printing in the US following the dovish meeting minutes. However, QE3 is definitely not certain in September. In New Zealand, inflation expectations remained stable, and this means no change in monetary policy anytime soon.

Updates: The kiwi continues to have a poor trading week, and has fallen below the 0.81 level. NZD/USD was trading at 0.8075. Building Consents will be released later on Wednesday. The markets are hoping for another strong release, following July’s impressive gain of 5.7%. The kiwi has lost ground, as NZD/USD trades at 0.8026. Builidng Consents posted a 2.0% gain, down from the 5.7% increase in the July reading. NBNZ Business Confidence continues to impress, as the indicator climbed to 19.5 points, a three-month high. NZD/USD is steady, as the pair was trading at 0.8008.

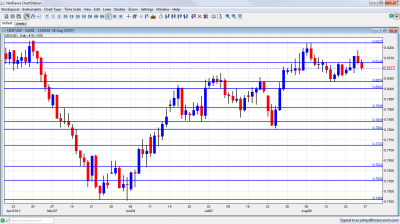

NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Building Consents: Wednesday, 22:45. The total number of building permits edged up 5.7% in June following a 5.7% plunge in May.Canterbury Earthquake-related reconstruction projects reached $45 million, including 27 new dwellings which is the largest regional increase in new building consents.

- NBNZ Business Confidence: Thursday, 1:00.New Zealand business confidence edged up in July to 15.1 from12.6 in June, amid improved forecasts for employment and investment conditions and in light of reduced concerns over European’s debt crisis. The commercial relations with Asia could boost NZ economy and soften possible harmful effects from the European debt crisis.

* All times are GMT.

NZD/USD Technical Analysis

NZD/$ started the week by a move upwards, but this didn’t go too far. A second attempt already reached higher ground, but also here, it was short lived.

Technical lines, from top to bottom:

Note that some lines have changed since last week. 0.8573 capped the pair in September 2011 and is distant resistance. 0.8505 served as support at the same time.

0.8470 was the swing high seen in February. 0.84 was resistance back in February 2012. 0.8320 was a wing high in April, just before the big dive.

0.8260 capped the pair during March, and is stubborn resistance. 0.8220 worked as stubborn resistance in August 2012 and joins the chart.

0.8125 separated ranges in August 2012 and is a minor line now. 0.8035 was a clear line of support in August 2012 and is now quite strong.

The round number of 0.80 managed to cap the pair in November and remains of high importance, especially due to its psychological importance. It was hit by the recent moves and somewhat weaker now. Another round number, 0.79, is key resistance, after being a very distinct line separating ranges. It proved its strength also in June 2012.

0.7840 provided support for the pair several times during June 2012 and also worked as resistance back at the end of 2011. The round number of 0.78 is significant support after working as such in July 2012.

0.7723 supported the pair back at the beginning of 2012 and also worked in the other direction in June 2012. 0.7620 provided support in May 2012 and is resistance once again, although weaker than in previous weeks.

0.7550 is resistance once again, even after the breakdown. It was a very distinct line separating ranges and had a similar role back in January.

I remain bearish on NZD/USD

While things in Europe are improving, the worrying Chinese data and a potential disappointment from Bernanke in Jackson Hole towards the end of the week could hurt the kiwi.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.

- For the Swiss Franc, see the USD/CHF forecast.