The IMF and the Eurogroup clashed over Greece’s long term targets and it seemed inevitable for the IMF to either cave in or leave the Greek program.

But now, the parties are throwing all possible ingredients into a Greek salad: everything except debt structuring and with some wishful thinking sauce on the top. EUR/USD is eating this towards the next Eurogroup meeting on November 26th. Will such an agreement be reached? Here are the 4 ingredients.

After the big haircut for private bondholders (which included banks and pension funds among others), most of Greece’s debt is in the hand of the official sector: the IMF, ECB bond buys and loans to Greece by the European governments, via the EFSF. The IMF sees Greek debt rising to 136% in 2020 under an optimistic scenario, unless significant measures are taken to reduce the debt.

In order to avoid losses, here are four ingredients in the salad:

- Greek austerity: Greece has already taken many painful measures. For a change, the country is receiving complements from the EU and the IMF on its progress. The political situation in the debt struck country is very sensitive, and Europe knows it cannot demand much more. However, it would not be totally surprising if the recent round of negotiations would result in more demands.

- Lowering interest rates on loans to Greece: This ingredient was always the preferred one by the EU, but everybody knows it will only reduce Greece’s debt very marginally.

- ECB Money: A long time ago, Draghi hinted about redistributing profits made on maturing Greek debt (which the ECB bought), could be used by the government for Greece. This would not be monetary funding according to the ECB. Also this sum, on its own, is not enough.

- Buyback: The last ingredient is a relatively new one: Greece would buy its bonds still trading in the market, at the discount price they are now traded in. The EU would lend the money, and this would allow Greece to reduce of 75% of this type of outstanding debt, which isn’t too high.

This would prevent euro-zone governments from accepting losses on loans to Greece, while the IMF will continue to lend money as well, accepting that Greece will return to more normal debt-to-GDP levels in the 8-10 years.

So far, weekly Eurogroup / IMF meetings resulted in disagreements and even a public clash. The next one is on Monday, November 26th. Will this be the final one?

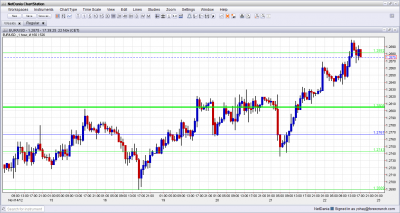

In the meantime, EUR/USD enjoyed this hope of an agreement to advance very nicely, securing 1.28 and even flirting with the next resistance line at 1.2880.

So, an agreement on Greece is priced in – EUR/USD could continue to 1.30 and a bit higher if hope turns into reality. Crossing tough resistance at 1.3170 doesn’t seem likely.

However, if no agreement is reached on Monday, the pair could plunge.

Further reading: