- USD: The better dollar tone in the wake of the FOMC minutes yesterday has raised the bar for a dollar-positive reaction to today’s employment report, as did the ADP data yesterday, so 200k+ likely required to give further initial boost.

- GBP: PMI services data at 09:30 the main focus, but notable that sterling was immune to the firmer data on the manufacturing side see on Wednesday, suggesting volatility risk is lower this time.

Idea of the Day

Up until the release of the Fed minutes yesterday, the price action showed that the yen that was the driving force, the extreme positioning on the yen – and on EUR/JPY in particular – made the currency vulnerable to the unwinding of short positions and this is what we were seeing through most of Thursday’s session. The discussion on ending bond purchases at the December meeting (as revealed in minutes released yesterday), put a large spanner into the works, boosting the dollar and knocking the yen from its better footing. The charts are more dollar-bullish, especially on EUR/USD and less so GBP/USD, but the uptrend on EUR/JPY is also waning on the charts so the yen could still put up a fight on some of the crosses and this is the better place to look for reversal opportunities.

Latest FX News

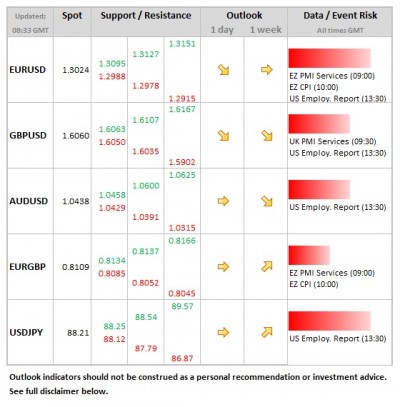

- JPY: The dollar was dominant overnight and undermining the better tone to the yen that emerged Wednesday and most of Thursday, just shy of 88.00 level overnight.

- USD: The latest FOMC minutes showed “several members” debating whether asset purchases should be stopped by the end of the current year. This was a surprise to markets and added to the strength of the dollar into the New York close.

- EUR: The pressure on the single currency at present is more down to positioning rather than anything fundamental, with break of trendline support at 1.3095 on EUR/USD favouring continuation of weaker tone.

- GBP: As with EUR/USD, the moves yesterday and overnight have called into question the uptrend in place for nearly two months now, with a close below 1.6115 today on cable further confirming this.