The new Japanese government was criticized for its efforts to weaken the yen, become more competitive and help exporters. So, instead of a “beggar thy neighbor” policy, Japan now wishes to hand out money to the beggars: the euro-zone.

Japan announced it will buy ESM bonds – the European bailout fund. EUR/USD is stabilizing on higher ground, and USD/JPY seemed to have topped out.

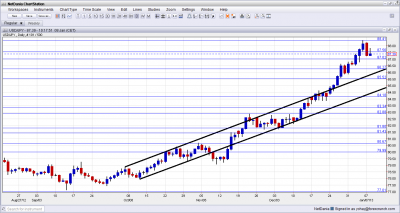

EUR/USD found a bottom at 1.30 late last week and now cements its climb above 1.31. 1.3130 caps the pair for now. USD/JPY reached a peak at 88.40 after the vertical climb, and is now sliding, still far from the uptrend channel.

“The financial stability of Europe will help the stability of foreign exchange rates, including the yen,”, said Japan’s new finance minister Taro Aso. His words came just before the ESM holds its first bond auction for the year. Japan will use its foreign exchange reserves for these buys. Details are still pending.

Europe finds itself in a problematic situation against this Japanese move: on one hand, Japan’s investment will lower the borrowing costs of the ESM and also encourage other investors to join in. Lower borrowing costs also allow the ESM to lend out money at better rates to Greece, easing the debt burden.

On the other hand, the move contributes to a stronger euro, weighing on European exports and making an exit from the recession much harder.

Further reading: