Idea of the Day

Things are very thin on the ground today in terms of economic data and in fact this week continues in a similar vein. With a limited move from FX markets overnight things just look to be tainted with a touch of risk aversion this morning. So in the absence of any big market movers on the agenda it could be prudent to keep an eye on the key levels today ahead of what is most likely to be the highlight of the week which comes in the form of the FOMC minutes on Wednesday. The markets continue to focus heavily on when the Federal Reserve might commence tapering its quantitative easing program and are even looking as far ahead as who will take over from Ben Bernanke when he steps down in January of next year.

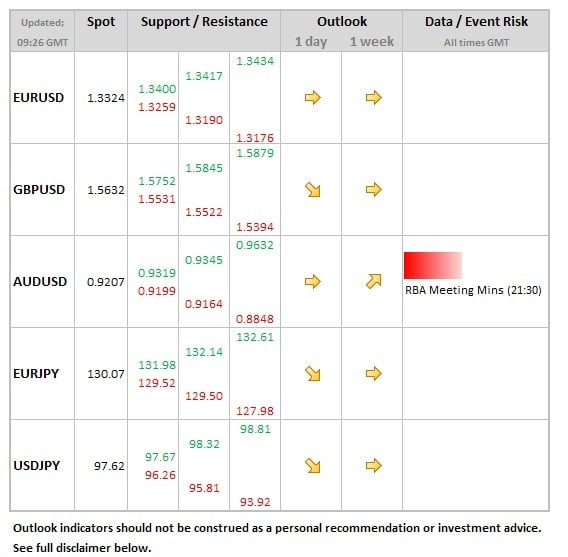

Data/Event Risks

EUR: Final inflation data should show the headline rate steady at 1.6%, which would be the sixth consecutive month inflation was below the ECB’s 2% threshold.

USD: Michigan confidence data does have a habit of upsetting things on a quite Friday afternoon if way out of line vs. expectations. The market expects a modest rise to 85.3 (from 85.1), but stronger data could push the dollar higher into the weekend.

JPN: Note that trade data is released on Monday and the focus will be on signs that the weaker yen of the past 8 months is starting to feed through into better trade numbers (small deficit, or possibly surplus). Short-term trends suggest this is slowly happening. Move into surplus would give the yen some further modest support.

Latest FX News

JPY: Japanese trade balance data overnight recorded its biggest ever deficit on record for the month of July as the weaker Yen kept exports high, but imports rocketed as demand for fuel increased during the summer months.

GBP: UK house prices look to have come off the boil month on month, as reported by the website Rightmove, which isn’t unexpected during the summer months. House prices in the UK still remain buoyant following the commitment from the BOE’s Mark Carney that he’ll keep base rates at 0.5% until unemployment falls to 7%.

Further reading:

Merkel sees no new debt haircut for Greece – oh well

US Consumer Sentiment falls to 80