The taper debate still carries on regardless and since the FOMC minutes last week the USD has been gaining some ground. That could potentially be halted today with the release of US consumer confidence that is expected to come in a little lower than July’s reading.

Those in favour of no tapering will be happy to see a weaker figure later today and this might be enough to soften the dollar’s little advance in recent days but if we see a figure that comes in higher than the 79.0 that’s expected we could see the little trend of dollar strength that’s been emerging continue.

There’s also the potential that any escalation of the geopolitical tensions in the Middle East could see investors heading into the dollar for safe haven reasons.

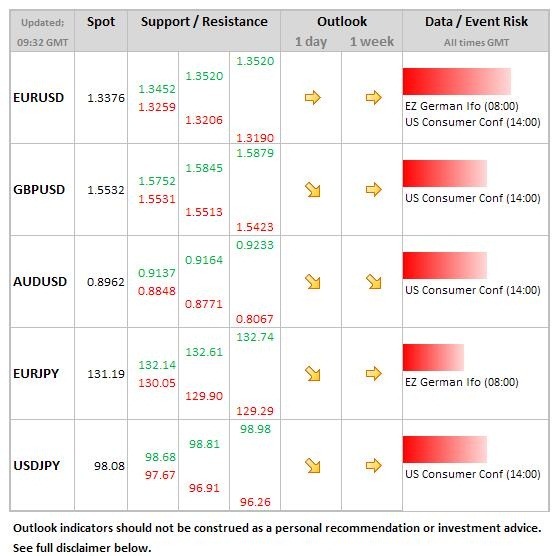

Data/Event Risks

EUR: This morning sees German Ifo Business Climate figures released which are expected to show a little uptick in sentiment. This could be perceived as good news for the euro area which has already dragged itself out of recession and could assist in keeping the single currency consolidating around its highs. Update: IFO exceeds expectations

USD: The big risk event for today comes in the form of US consumer confidence. Confidence in the consumers of the world’s biggest economy has gradually been improving in recent months taking many by surprise however today’s figure is expected to dip just a little and has the potential to just give the USD a little pause for breath as so far this morning we’ve seen it make mild gains against most other majors.

Latest FX News

GBP: The Confederation of British Industry has made some bullish comments about the prospects of the UK economy as doubts continue over just how dovish the new BOE’s governor has been with his forward guidance. More is expected from Mr Carney in a lunchtime speech he is due to make tomorrow.