Idea of the Day

Now August is out of the way investors will reflect on a month that disappointed in terms of market movements and volumes were low overall as can be expected at this time of year. Having moved into the month of September expectations are building for what could turn out to be a volatile month.

The geopolitical situation in many parts of the globe could get very interesting with elections in Australia this week end and then German elections later on in the month. At the same time it’s impossible to say that the situation in Syria has improved all that much, despite the risk appetite that’s filtered through into the markets this morning, as Obama refused to go it alone in bombing the country there’s every chance still that a military strike could happen in the days or weeks ahead. The month of September has in the past had a knack of throwing some surprises at the market so there’s little reason to suggest this one will be any different as many people return to their desks from summer holidays.

Data/Event Risks

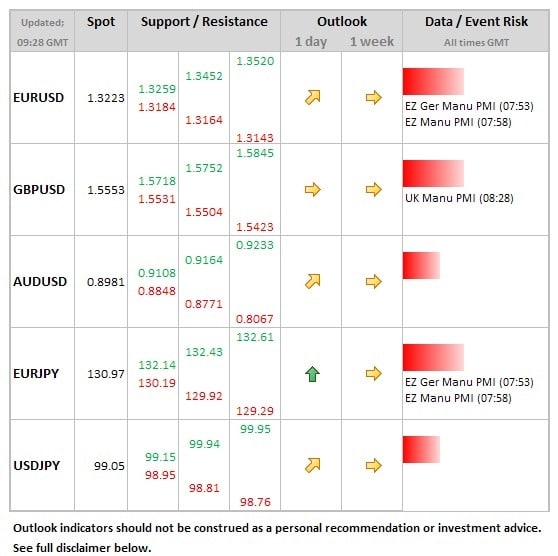

USD: Things are likely to be quite quiet today as it is the public holiday of Labor Day in the US. As a result all eyes will be on the economic data out of Europe and the UK in what is likely to be a session of thin volumes. The week gets busier of course with the interest rate decisions from the BOE, ECB and then nonfarm payroll data from the US on Friday.

EUR: There is a raft of manufacturing data due out from the Eurozone including releases from Italy, France and Germany. This all has the potential to shift the euro although expectations are for most of the readings to be flat, in line with the previous month.

GBP: The UK is also due to release its manufacturing PMI this morning which can often lead to a move in sterling. The economic data from the UK has been coming in consistently stronger than expected in recent weeks so another good number is due to hit the wires with the PMI figure due to come in at 55.0 up from 54.6.

Latest FX News

JPY: The introduction of a sales tax by Shinzo Abe got the backing it needed and so the Yen has been softening this morning. All part of the so-called “Abenomics” monetary policy already this morning we’ve seen USDJPY recapture the 0.9900 level

AUD: A strong Chinese manufacturing PMI figure last night has given a little bit of a boost to the Aussie Dollar this morning. Whilst some were expecting the figure to be a little stronger, it has marked a return to back above the 50.0 threshold indicating expansion for the sector. Eyes will remain one Aussie for the remainder of the week in the build up to this week end’s general election.

Further reading:

Forex Analysis: GBP/USD Continues Retreat after Downturn

Weak GDP in Canada adds pressure on the Canadian Dollar