Idea of the Day

There’s an underlying nervousness in markets that was evident yesterday as gold and other assets reacted to the US/Israeli missile test and with Congress offering its backing to limited US action in Syria. When this will happen is not clear, so we could well see some caution today and possibly for the rest of the week. Given the scale of other military campaigns of recent years, the impact economically is marginal. Politically, there are bigger ramifications that may not have an immediate impact for markets, but could change the interplay between nations and we may get a sense of this as G20 leaders gather in St. Petersburg tomorrow and Friday. Near-term, expect markets to remain on edge and if there is a strike on Syria, for the dollar to gain, as well as oil and gold, with likely erosion of moves in the coming days

Data/Event Risks

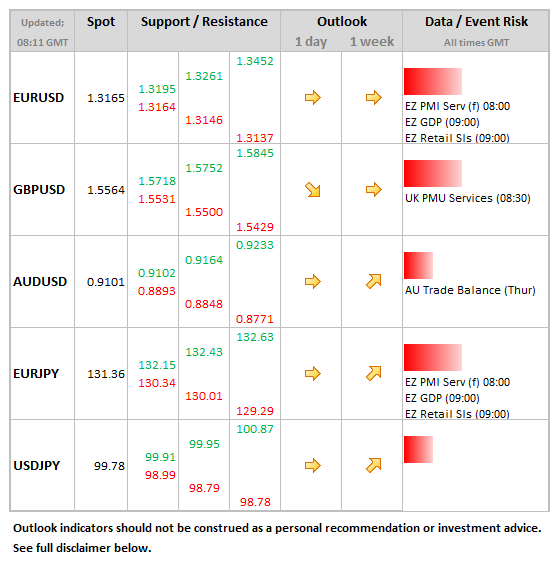

GBP: The PMI surveys continue in earnest today and this morning sees the UK’s services figures. If the recent PMI releases are anything to go by, where both the manufacturing and construction PMIs exceeded expectations, then we could see a hat-trick of economic data that indicates the UK economy is recovering far quicker than many had previously expected.

EUR: There are PMI services surveys due to be released from many of the Eurozone members this morning, including the block itself, as well as GDP and retail sales GDP data. The euro has a great deal to absorb today especially after having just commenced a rather negative near term downward trend.

CAD: The Bank of Canada kicks off the central bank interest rate decisions this week with its announcement where they are expected to keep interest rates at 1.00%, the same level since September 2010. Having taken over from Mark Carney who is now the Governor of the Bank of England, Stephen Poloz is expected to make his mark by adjusting the forward guidance set out by his predecessor.

Latest FX News

USD: The USD had been under pressure from good UK data earlier in the day but it recovered somewhat after better than expected manufacturing and construction figures of its own. This boosted expectations of tapering this month lifting the dollar against most other majors.

AUD: GDP data for Q2 slightly firmer and giving the Aussie a lift to a high of 0.9106 during the Asia session. GDP expanded 0.6% (expected 0.5%), with this enhancing the view that the RBA is most likely done in cutting interest rates. This could well give further support to Aussie rallies near-term

EUR: Touching 6 week lows vs. the USD and so far falling for the sixth consecutive session. The data has been supportive, together with contraction of ECB balance sheet, but sovereign strains still lie beneath and return of politicians from holidays brings a sense that these could move to the fore again in terms of the news agenda.

Further reading:

ISM Manufacturing PMI exceeds expectations – dollar extends gains

Forex Analysis: USD/JPY Breaks Out Towards Major 100.00 Resistance