The pound’s slide continues, as GBP/USD lost about one cent this week. The pair closed at 1.5946, marking the first week the pair has closed below 1.60 since early September. This week’s key events are CPI, Claimant Count Change and Retail Sales. Here is an outlook of the events and an updated technical analysis for GBP/USD.

The pound took a mid-week hit, following a poor Manufacturing Production release. As well, the trade deficit was well above the estimate. The US posted a weak consumer confidence release on Friday, but the pound was unable to take advantage.

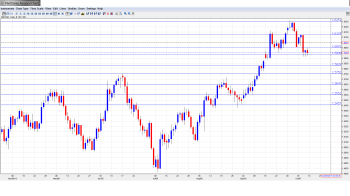

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- CPI: Tuesday, 8:30. CPI is one of the most important economic indicators and this release can have a major impact on the movement of GBP/USD. CPI has been fairly steady in recent readings, with the previous release of 2.7 matching the forecast. A similar reading is expected in the September release, with an estimate of 2.6%.

- PPI Input: Tuesday, 8:30. Producer Price Input is a key release which measures inflation in the manufacturing sector. Unlike CPI, this inflation indicator tends to show some volatility. The estimate for the upcoming release stands at -0.1%.

- RPI: Tuesday, 8:30. Retail Price Index is similar to CPI, but includes housing costs, which are excluded from CPI. The market has been posting gains slightly above 3% in recent releases and this trend is expected to continue for the September release, with an estimate of 3.2%.

- Claimant Count Change: Wednesday, 8:30. This critical indicator has been improving recently and the August release posted a sharp drop of -32.6 thousand, easily beating the estimate of -21.2 thousand. Another strong drop is anticipated in September, with a forecast of -24.3 thousand. Will the indicator again beat the estimate? The Unemployment Rate is expected to remain at 7.7%.

- Average Earnings Index: Wednesday, 8:30. Average Earnings looks at the change in price that government and businesses are paying fro labor. The indicator dropped to 1.1% last month, and a similar reading is expected in the upcoming release, with an estimate of 1.0%.

- Retail Sales: Thursday, 8:30. Retail Sales is considered the most important consumer spending indicators, and should be treated as a market mover. The indicator disappointed in August, declining by 0.9%. The markets are expecting a turnaround in September, with the estimate standing at 0.5%.

Live chart of GBP/USD: [do action=”tradingviews” pair=”GBPUSD” interval=”60″/]

GBP/USD Technical Analysis

GBP/USD opened the week at 1.6040. The pair reached a high of 1.6120, but then crashed below the 1.60 line and dropped all the way to 1.5914. The pair closed at 1.5946, as support at 1.5936 (discussed last week) held firm.

Technical lines from top to bottom:

With the pound continuing to slide, we start from lower ground:

There is resistance at 1.6475, which has held firm since August 2011. Next is 1.6343. This line was last breached when the pound dropped sharply in August 2011.

We next encounter resistance at 1.6247. This was a key resistance line in October and November 2012.

1.6125 held firm as the pair pushed higher early in the week. It has some breathing room as the pair has dropped below the 1.60 level.

1.60, a key psychological barrier, started the week in a resistance role but has reverted to support. It is a weak line and could be tested early in the week.

1.5936 is the next support level. It held firm this week but has weakened with the pair continuing to lose ground.

1.5832 continues to provide the pair with strong support. 1.5752 was breached in mid-September by the surging pound but has provided strong support since then.

1.5648 was an important resistance line since June, but has been providing support role since early September.

1.5550 continues to provide GBP/USD with strong support. This line last saw action in mid-June.

The final support line for now is 1.5457. It as held firm since late August.

I am neutral on GBP/USD.

The pound enjoyed an excellent rally in September, but October has been a different story, as the currency has lost ground for the second straight week. It could be a bumpy ride for the pair this week, with the shutdown and debt ceiling weighing on the US dollar. However, if Congress manages to reach an agreement, the dollar could gain ground.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.