Idea of the Day

So we are still waiting for the US to sort itself out. Meanwhile, it should be no great surprise that one of the ratings agencies (Fitch) has put their US triple-A rating on review. Back in the summer of 2011, S&P stripped the US of its triple-A rating on the back of the debt ceiling negotiation taking place at that time, which were resolved right up against the deadline. Whilst in theory the US will run out of money this week, it’s anticipated that it will be able to pay its bills up to the end of the month. Big payments occur on the last day of this month and on the 1st of November and they are the hurdles that are seen as being pretty impossible to pass without the debt ceiling being raised. The dollar saw a fairly choppy late NY session yesterday as news of the talks gave conflicting messages. More of the same is likely today as Senate leaders once again put together a package that can be voted on by the House of Representatives. If no deal is worked out, the dollar will weaken, but not drastically so as markets expect that the US can survive for the coming week or so. It won’t be a comfortable time though.

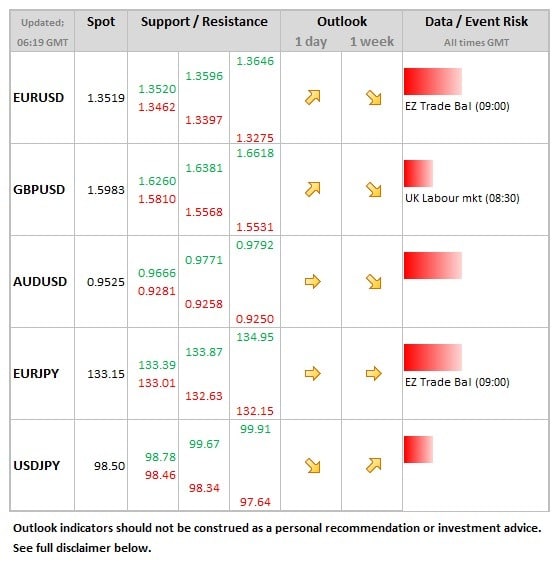

Data/Event Risks

GBP: Recall that the Bank of England set an ‘intermediate threshold’ of the unemployment reaching 7%, a bit the same as the 6.5% mentioned in the US. This naturally increases the significance of the monthly labour market numbers for sterling. Last month the rate (LFS measure) moved from 7.8% to 7.7%, which initially added one big figure to GBPUSD.

USD: Many data releases still delayed by the government shutdown, but talks continue and resolution today still looks to be on the cards, if the stories out of Washington are to be believed.

Latest FX News

USD: Staging a fight-back yesterday, but weaker into the NY close as deal proved elusive. Slightly softer than expected ZEW data in the Eurozone proved to be the catalyst, but follow-through seen on most other currencies, taking dollar to levels not seen since the Fed stepped back from tapering after the September meeting (on dollar index measure)

AUD: Momentum following through after the release of RBA minutes, so Aussie now put in the fifth day of gains. We wrote earlier in the week on our blog regarding the Aussie and why recent gains are happening and could well be sustained.

GBP: CPI data showed inflation holding steady at 2.7% (expected to fall) and this allowed sterling a brief push above the 1.60 level against the dollar and we start the European session in a similar position. Sterling is still looking toppy on some measures, most notably vs. recent data and also on short-term interest rate differentials.

Further reading: