AUD/USD tumbled last week, dropping two cents. The pair closed the week at 0.9167. This week’s key event is Private Capital Expenditure. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

The Aussie took a hit after RBA Governor Glenn Stevens said he was open to currency intervention to push down the Australian dollar, which could mean reducing interest rates. As well, a strong Unemployment Claims out of the US gave a boost to the US dollar at the expense of the Australian currency.

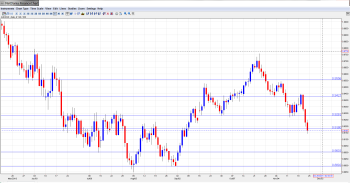

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- RBA Deputy Governor Philip Lowe Speaks: Monday, 22:15. Lowe will deliver remarks at an event in Sydney. Analysts will be looking for hints as to the RBA’s future monetary policy, particularly regarding interest rates.

- Construction Work Done: Wednesday, 00:30. This indicator is released on a quarterly basis, magnifying the impact of each release. The indicator has been struggling, posting declines in four of the past five quarters. However, the markets are expecting a turnaround for Q23, with an estimate of a 0.6% gain. Will the indicator meet or beat this prediction?

- HIA New Home Sales: Thursday, Tentative. New Home Sales is an important gauge of housing activity as well as consumer spending. The indicator tends to fluctuate widely, often leading to markets estimates which are well off the mark. The most recent release came in at 6.4%, the sharpest gain since April 2012. The markets will be hoping for another strong gain in the upcoming release.

- Private Capital Expenditure: Thursday, 00:30. This is the major event of the week. Private Capital Expenditures, released each quarter, measures the change in new capital expenditures made by businesses. The indicator rebounded nicely last month, posting a sharp gain of 4.0%, a five-month high. This easily beat the estimate of 0.5%. The markets are braced for a sharp downturn in Q3 ,with an estimate of -1-1%. Will the indicator repeat with a stronger showing than expected?

- Private Sector Credit: Friday, 00:30. This indicator measures borrowing in the private sector. Increased borrowing usually results in more spending, which is crucial for economic growth. The indicator has been very steady, and little change is expected in the upcoming release, with an estimate of 0.4%.

*All times are GMT

AUD/USD Technical Analysis

AUD/USD started the week at 0.9369 and rose to a high of 0.9448 early in the week. However, it was all downhill from there, as the pair crashed below the 0.92 line, dropping to a low of 0.9143, breaking below support at 0.9180 (discussed last week). The pair closed the week at 0.9167.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

With the Aussie taking a beating last week, we start at lower levels:

0.9556 continues to provide strong resistance. 0.9428 was busy in the first half of October and started the week in a resistance. It held firm this week but remains weak. This line could see action early in the week if the Aussie reverses direction.

0.9283 saw a lot of action in the months of June and July, alternating between resistance and support roles. It has provided steady support since mid-September.

0.9180 was breached by the pair as it dropped sharply. This line has reverted to a support role, and is a weak line. It could see action early in the week.

Next is the round number of 0.9000. This psychologically important level was breached in early September, when the Australian dollar started a strong rally which saw it break past the 0.95 line.

0.8893 has been a strong support line since August 2010, when the Australian dollar put together a strong rally which saw it climb above the 1.10 line.

0.8728 is the final support level for now. This line was last breached in July 2010, when the Australian dollar began an extended rally that saw it climb close to the 1.10 line.

I am bearish on AUD/USD.

The RBA is taking every opportunity to talk down the Australian dollar, and this could continue to weigh on the currency. As well, QE tapering is likely in the short run, and this is a US dollar-positive event.

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar.