Idea of the Day

So as December gets underway and US investors return having recovered from their Thanksgiving festivities, we look ahead to see what the final month of 2013 has in store for us. There have been many surprises this year, the main one being the UK economy’s ability to stave off a triple digit recession and actually turn things around economically in quite some style. Traders will be looking to see if this can be translated into the usual “Christmas Rally” that the FTSE has seen historically in December following a more than lacklustre November for the index. Sterling has also surprised traders with its recent strength and GBP will be in focus today as the first bout of PMI readings are released with the manufacturing figure due this morning. Manufacturing surveys are due across the Eurozone too so it will be interesting to see if the disconnect between the UK and Eurozone puts further downward pressure on EUR/GBP which has already dipped below 0.8300 this morning.

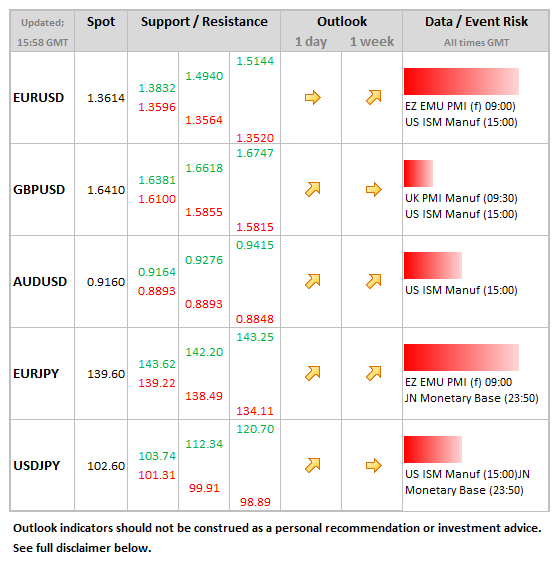

Data/Event Risks

GBP: The past two months have seen manufacturing PMI fall after what was an unbroken rise from April of this year. Expectations are for the figure to remain at 56.0, which should keep expectations alive for another decent quarter of growth. Sterling is looking a little stretched vs. the dollar now that it has climbed above the 1.6400 level, so a weaker number could see the currency more vulnerable to some profit-taking.

USD: The ISM manufacturing series has risen for 5 consecutive months now, so the market is looking for a small pull-back to 55.0, from 56.4, with the prices balance easing also. Stronger data could spur the dollar into a firmer tone, more so vs. sterling and euro where losses have been strongest recently.

Latest FX News

CNY: As mentioned December historically is a month that sees increased risk appetite and this morning has already seen Chinese manufacturing data come in slightly higher than expected which has already caused the dollar to dip in early trade.

EUR: A very tight range on Friday. Even a firmer than expected inflation estimate for the Eurozone failed to lift the single currency, although firmer data from Germany yesterday gave an indication where the risks were on the number, which rose from 0.7% to 0.9%. That said it probably takes the pressure off the ECB this week to indicate of further policy measures to come.

AUD: Struggling to hold its own for the week as a whole, but there were signs of buying interesting in the 0.9060/70 area towards the latter half of the week, which have fed through to today taking AUD/USD to 0.9160 following much better than expected building approvals data.

USD: A mixed week, softer against sterling, euro and the Swissie, but firmer against the yen, Aussie, Canadian and kiwi.

Further reading: