Idea of the Day

We have arrived at decision day for the Fed. We continue to see around a 40% chance that the Fed starts tapering (reducing the amount of monthly bond purchases) as early as today. Currently they are buying USD 85 bln of securities a month. From May to September this year, the market really feared the consequences of pulling back from such purchases. Since then, the FOMC have been at pains to underline that tapering does not mean that interest rates are going to rise anytime soon. As such, even if the Fed does taper today, the positive impact on the dollar is going to be less than would have been the case had they done so in September. The Aussie continues to be the most vulnerable in a tapering scenario, given that the central bank (RBA) has made it clear that it still wants to see the currency lower.

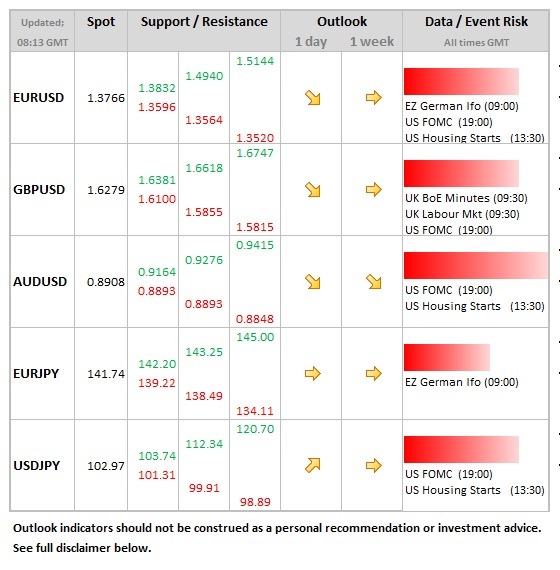

Data/Event Risks

USD: The Fed decision comes at 19:00 GMT. Polls suggest that the market is perhaps 30-35% priced for tapering or some sort, so dollar volatility assured whatever the outcome. Even if there is no tapering, an adjustment in the language could easily instigate a positive reaction if it hints at tapering to come in the nearer future.

GBP: Jobs data is released, which remains key since the BoE made the unemployment rate an ‘intermediate threshold’ for policy, meaning they won’t consider raising rates (with various caveats) at least until unemployment has reached 7.0%. Market expects this to remain steady at 7.6%. Minutes to December MPC meeting are also released, but seen as low event risk for sterling.

Latest FX News

JPY: Weaker overnight after further deterioration of the Japanese trade deficit of JPY 1.35 trn. The data has been weakening for some time, not helped because Japan now had to import a lot more energy. USDJPY was pushed to the 103 level, with EURJPY stalling just below the 142 barrier.

USD: There were mixed messages from the CPI data yesterday, with the headline rate slightly softer than expected at 1.2%, with core prices steady at 1.7%. The dollar was relatively unphased, the dollar index trading in the middle of the range that had held for the past week.

AUD: Some recovery being seen after RBA governor Stevens suggest that there are signs that lower interest rates are starting to support the economy, reducing the risk that we see further rate cuts from the already low 2.5% level. For now, AUDUSD is holding above the 0.89 level.

Further reading:

EUR/USD Dec. 18 – Rangebound Ahead of Fed Statement

FOMC Preview: Dectaper coming? 5 Scenarios