Idea of the Day

Sterling was feeling a little heavy yesterday, with cable pulling back from the 1.65 level early on. The key is how long the stronger recovery story still has to run. Sterling was one of the strongest performers on the majors in the second half of last year, defying expectations that a commitment from the BoE to keep rates low would weaken the currency. Rate expectations have slowly been shifting, although tightening still remains some way off. Today’s inflation numbers could potentially see headline inflation back at the 2% target for the first time in over four years, which would no doubt be another feather in the cap of the newish Bank of England governor.

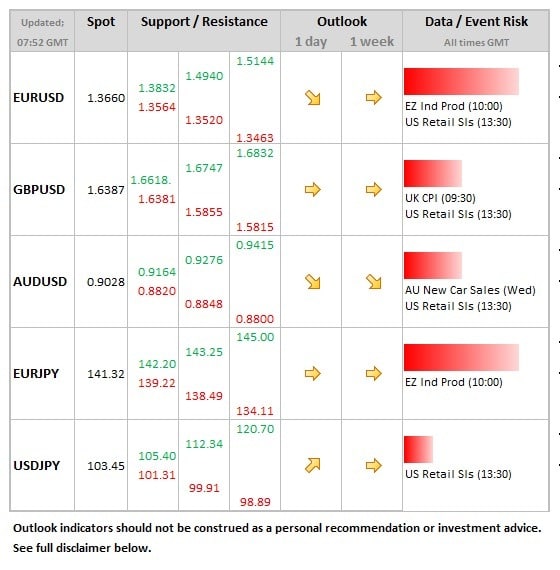

Data/Event Risks

USD: Retail sales data for December are always a bit of a gamble in terms of getting the seasonal adjustments right. Market looks for headline sales to rise 0.1%, after 0.7% increase in November. In the wake of the weaker employment report, the dollar could be vulnerable to a negative reading. Note that hawkish Fed speakers are on the agenda this evening (Plosser and Fisher), but should not impact greatly given views widely known.

GBP: Both headline and core inflation readings are seen steady at 2.1% and 1.8% respectively when released this morning. Sterling was under pressure yesterday and could be vulnerable to weaker reading.

Latest FX News

EUR: We noted last week that the euro was displaying some underlying resilience, recovering quickly from the lows seen in the wake of the ECB press conference. Some further gains being seen in early part of the European session, towards the 1.37 level on EURUSD.

GBP: A weaker tone emerging during Monday, with cable pulling back from the 1.65 level. Initial support seen is seen at 1.6381. EURGBP has also seen a strong turnaround, back above the 0.8330 level overnight.

Gold: Trading at a four and a half week high above the 1,250 level. Gold is all about sentiment and so far this year, it has been cautiously optimistic.

Further reading:

EUR/USD Jan. 14 – Tests 1.37 Ahead of US Retail Sales

British inflation falls again to 2.0% – GBP/USD retreats from highs