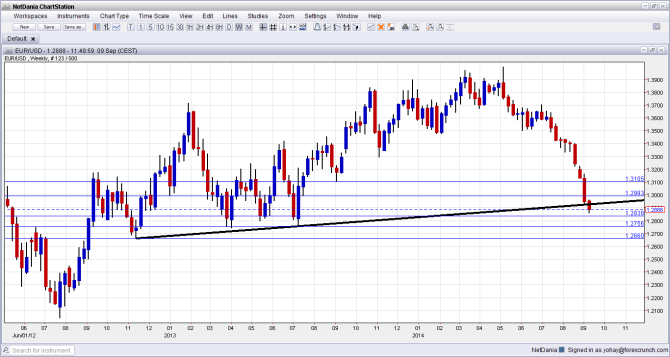

EUR/USD trades above uptrend support since November 2012. After abandoning the line somewhere during 2013 when the pair was moving up, the recent fall sent it back down to test the line.

The line held nicely for a short while, and now it’s safe to say that it collapsed. Looking at both the daily and weekly charts, we can see that the pair is trading well below this line.

Here is the weekly chart, more explanations below:

While the stubborn euro could still stage a recovery and retake the line (as we’ve seen in the past), it will need more than a dead cat bounce to do so, and only dead cat bounces are in sight. The delay in EU sanctions against Russia did not really help the pair, nor did some weak data from the US.

Draghi’s surprisingly strong measures as well as the dollar storm have the upper hand.

1.2859 is the current low, the lowest in 14 months. From here, the next support line is 1.2840, which worked as support in mid 2013. Stronger support awaits at 1.2750, which cushioned the pair twice in 2013. The last strong line is 1.2660, where this uptrend all began back in November 2012.

On the upside, 1.2920 and 1.2955 provide resistance before the round number of 1.30.

For more, see the EURUSD forecast.