The New Zealand dollar had a positive week, climbing back up. Is 0.80 within sight? The main event is the release of the quarterly retail sales report. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

The Business NZ Manufacturing Index is on the rise, and at 59.3 points it reflects strong growth. Also house prices, as reflected by the REINZ HPI, are showing good signs. Together with last week’s excellent jobs report and a correction of the dollar rally seen beforehand, the kiwi made a nice comeback, better showing the strength of the local economy. Can this continue?

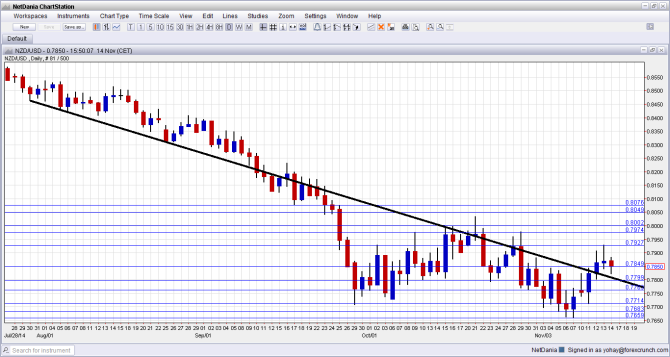

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- Retail Sales: Sunday, 21:45. Changes in the volume of retail sales are published only once per quarter, making them even more important. This measure of consumer spending rose by 1.2% in Q2 2014, and is now expected to show a somewhat slower growth rate for Q3: 0.8%. Also core sales, which exclude auto-related purchases, grew by 1.2% in the second quarter, and also here, a more modest rise of 1% is expected

- GDT Price Index: Tuesday. The bi-weekly report on the global dairy trade is critical for the kiwi as the country’s no. export product is milk. After a few big moves in previous releases, a drop of only 0.3% was reported last time. A small rise is likely now.

- PPI: Wednesday, 21:45. While CPI is the key inflation figure, also producer prices are important. PPI Input, which reflects prices of raw goods purchased by manufacturers, disappointed by falling 1% in Q2. A rebound with a rise of 0.3% is predicted now. PPI Output, which carries less wait, fell by 0.5% and could rise by 0.2%.

- Credit Card Spending: Friday, 2:00. As retail sales are published only on a quarterly basis, this leading release of the credit card spending gives a more updated picture. After a rise of 4.4% in September, a similar y/y rise is expected for October.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/dollar started the week with a move above the 0.7765 line (mentioned last week), which proved to be a clear separator of ranges. A drop was followed by a decisive break. The pair continued higher and hit resistance at 0.7930 before retreating.

Live chart of NZD/USD:

[do action=”tradingviews” pair=”NZDUSD” interval=”60″/]Technical lines, from top to bottom:

0.8312 was the low point in August 2014 and it also follows the downtrend support line. The next line is 0.8270, which was the low point in September.

Further below, the round levels of 0.82 is certainly worth watching. It is followed by the initial September low of 0.8120.

0.8075 was one of the cycle lows and now works as resistance. Even lower, 0.8050 provided support for the pair back in February and is the last line before the very round figure of 0.80.

0.80 is now key resistance on the upside. Just below, the old resistance line of 0.7975 is coming back to play after capping the pair in October.

0.7930 was a double top in October’s recovery and is important to watch. It is followed by 0.7850.

0.78 is a round number and provided support various times, including recently. Going deeper, 0.7765 worked as support, and is a line to watch on the way down.

0.7715 is stronger support after serving as a cushion for the pair in September 2013. 0.7660 is the new low in November 2014, making it key support.

Below this point, we are back to levels last seen in 2012: 0.7615 is initial support and the critical line is 0.7460.

Downtrend line now works as separator

The pair traded above a downtrend support line that accompanied it from July and eventually dropped below this line.It recently managed to break back above the line, which continues serving as a separator between trading ranges.

I turn from neutral to bullish on NZD/USD

The strength of the local economy continues shining, and retail sales could serve as a reminder. And while its peer commodity currencies are suffering from falls in their exports, New Zealand’s milk exports are more stable, and the fall in energy prices actually serves as a boost for the local economy. In the US, things do look quite good, but the dollar could extend the break from its rallies for another week.

More kiwi:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.