The Australian dollar trades below 80 cents against the US dollar. Does it have more room to fall or can it recover?

The team at Credit Agricole explain against which currencies the Aussie is a sell:

Here is their view, courtesy of eFXnews:

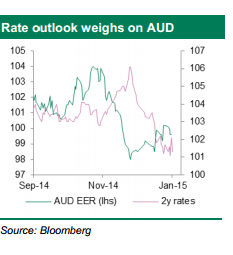

Regardless of improved risk sentiment we expect the AUD to remain a sell on rallies, at least against the USD. This is mainly due to the risk of the RBA turning more dovish. Although the latest employment data suggests improving labour market conditions the risk of further slowing price developments remains intact.

This is mainly due to weak external demand conditions as related to Asia and weak commodity price developments. Accordingly it cannot be excluded that next week’s CPI will disappoint.

Under such conditions the RBA is likely to continue regarding monetary conditions as too tight, which will continue to be reflected as they maintain a cautious stance when it comes to the AUD’s overvaluation.

All of the above stands in contrast to the US. Further improving growth prospects and the Fed regarding more muted inflation expectations as transitory, should keep investors’ Fed rate expectations well supported.

As such there is room of further diverging RBA-Fed rate expectations to the detriment of the cross.

We favour selling AUD rallies versus USD, GBP and NZD, but not against EUR.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.