Japan has experienced lost decades of deflation. Is this fate awaiting the euro-zone?

The team at Morgan Stanley discusses this: The EUR Imitation Game; Is EUR The New JPY?

Here is their view, courtesy of eFXnews:

In a note to clients today, Morgan Stanley discusses whether Japan’s and Europe’s respective currencies are developing similar behavior.

The Japanification of the Eurozone:

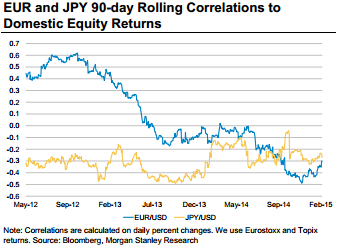

“JPY has a tradition of behaving counter to investor risk appetite; it rallies on negative news, both foreign and domestic, and depreciates when sentiment is positive. In short, it behaves like a true global funding currency,” MS notes.

How EUR Becomes JPY?

According to MS’ view, currencies like JPY or the pre-floor CHF trade inversely to risk appetite because they have:

“1) Very low interest rates compared to other countries, increasing the incentive to fund higher-yielding investments abroad. 2) High foreign-hedge ratios on domestic assets, such that risk-seeking foreign inflows have a smaller impact on the currency. 3) A large net external asset position, so when risk appetite sours, local investors repatriate,” MS clarifies.

“EUR’s history of positive beta performance reflects that it did not check the boxes above. However, over the last year, EUR has ticked off both the first and second prerequisites required for a currency to trade inversely to risk. It has yet to fulfill the third, which explains why EUR has not developed a significant negative beta to positive risk appetite for now,” MS argues.

Bottom Line:

“While EUR may be gradually evolving into a negative-beta currency like JPY, it is not there yet. The bearish EUR trade does not require a risk-on environment.While short-term position adjustments are always a risk, we do not see a shock to sentiment as powerful enough to reverse the EUR downtrend,” MS concludes.

At the same time, increased foreign investor hedging of European equities is beginning to mirror Japan’s experience. This is limiting EUR’s ability to gain from equity inflows. As long as foreign investor hedging of European equities is popular, we expect EUR rebounds to be shallow and short-lived,” MS adds.

EUR Forecasts:

MS sees EUR/USD trading at 1.08 by end of Q2 and by 1.05 by the end of the year.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.