The weak US Non-Farm Payrolls were blamed on the weather. While this finger pointing didn’t initially help the dollar, the greenback is recovering as traders come back from their Easter holidays.

The team at Bank of America Merrill Lynch analyzes the next move in EUR/USD:

Here is their view, courtesy of eFXnews:

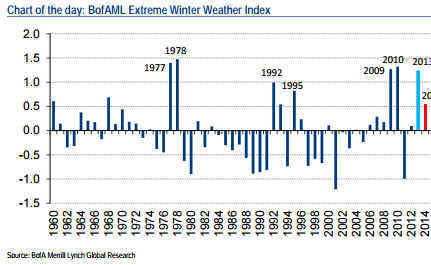

“In our view, the key question is whether the recent slowdown in US growth is due to temporary factors. In particular, how important has been the role of the weather and how much of the slowdown can be attributed to it.

After the release of the March NFP on Friday, the market has pushed back the first full Fed hike to October and EUR/USD moved above 1.10.

…For investors who share our view that as the weather turns the economy will rebound quickly, we believe this creates an opportunity to start building short positions in the front-end of the US yield curve and adding to long USD positions, especially just before the release of the critical March retail sales data on 14 April.

We have been recommending a Treasury-Bund spread tightener for a while. With the spread tightening 30bp in the past few weeks, we think this is a good time for investors who have made money on the trade to consider locking in the profits.

We are confident the EUR/USD downtrend will resume at the first sign of arrival of a warmer spring.”

David Woo and Shyam Rajan – Bank of America Merrill Lynch

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.