The Australian dollar is somewhat on the back foot since topping 0.80. Will this retreat continue?

The team at Barclays sees more easing bias from the Reserve Bank of Australia and a sell opportunity:

Here is their view, courtesy of eFXnews:

“An RBA easing bias and robust US economic data should push AUDUSD lower this week…After cutting rates to a record low of 2% in May, we expect the RBA to keep the cash rate steady in June. We think the RBA has an easing bias, reflecting its forecast profile, where the average underlying inflation rate over 2016 is expected to be slightly below the midpoint of the target range, and supported by recent comments by the Deputy Governor who said that “we still have scope to lower rates if we need to”,” Barclays projects.

“We think the bias will have likely been boosted by the unexpectedly poor outlook for non-mining investment from the Q1 capex survey. Aside from an easing bias, we also expect the RBA to again make the case for further weakness in the AUD exchange rate given the state of commodity prices,” Barclays adds.

On the technical front, Barclays’ rationale is as follows:

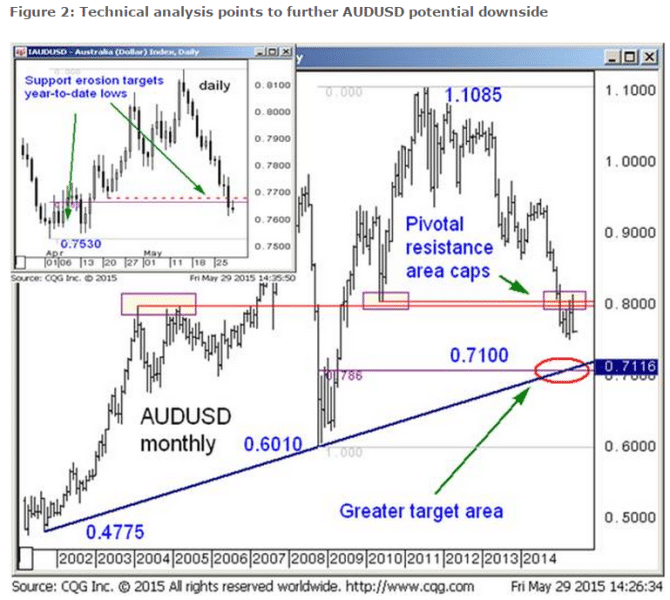

“In addition, our bearish AUDUSD technical view was recently encouraged by the break below support in the 0.7670/80 area on increased trading volumes,” Barclays argues.

“We are now looking for further downside in the near-term towards our initial targets near the 0.7530 year-to-date lows. A break below these lows would add to our bearish conviction and signal further downside towards a cluster of support in the 0.7100 area that act as our greater targets,” Barclays projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.