The Australian dollar is not going anywhere fast, but this could certainly change rapidly.

And to what direction? The team at Credit Suisse analyzes:

Here is their view, courtesy of eFXnews:

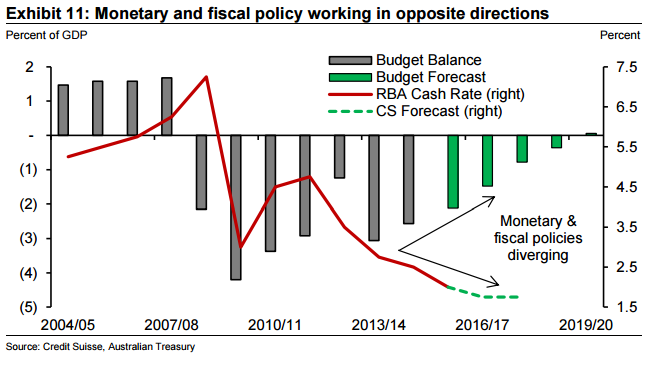

“The lack of fiscal stimulus to accompany record low interest rates has kept the RBA more dovish than it may otherwise prefer. This overdependence on easy monetary policy has been a key factor behind our bearish AUD view.

However, the RBA (among others) has grown increasingly vocal about Australia’s need for more than just easy monetary policy to compensate for the collapse in mining investment and the sharp decline in the terms of trade.

The argument for fiscal stimulus and infrastructure investment – rather than the government’s current focus on balancing the budget – could become a major theme going into the 2016 federal election.

Australia has one of the strongest fiscal positions globally, with a gross debt-to-GDP ratio of 34%. With borrowing rates at record low levels, the opportunity cost of paying down debt is high.

While we do not anticipate the possibility of fiscal stimulus having a material impact on our bearish AUDUSD forecast profile or our call for further RBA rate cuts – it is a key risk over the longer term and a reason why we haven’t lowered our 12-month forecast below 0.70.

Fiscal spending would allow the RBA to turn less dovish, supporting AUD via wider rate differentials. We would expect this to outweigh any rating downgrade concerns – despite Australia’s negative net international investment position and its high percentage of sovereign debt held by non-residents.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.