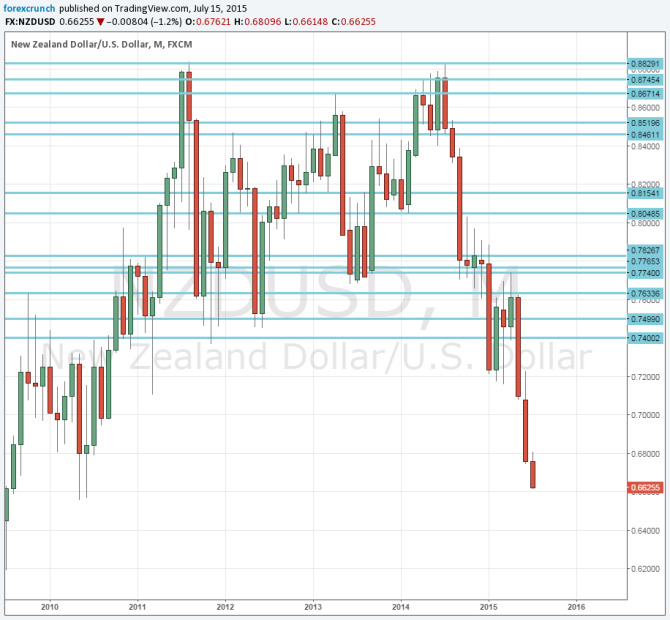

Everything continues going against the kiwi and after one week of correction, NZD/USD hits a new 5 year low at 0.6614.

The kiwi was hit by yet another fall in milk prices and upbeat comments from Fed Chair Janet Yellen who didn’t say anything earth shattering but still wasn’t a rate hike in 2015.

The Global Dairy Trade dropped 10.7%. This spilled milk is a big drop even for this volatile indicator, and an 8th consecutive fall. Milk shows it is now different from other commodities.

In the US, Fed Chair Yellen repeated her words regarding a rate hike sometime this year. This isn’t new and she was very cautious as usual, but the background is yet another disappointing retail sales report. Her unchanged stance contradicts the bearish sentiment and this contradiction lifts the kiwi.

The New Zealand dollar is not the only commodity currency suffering today. The Canadian dollar leaped higher as the BOC cut the interest rate. AUD/USD is also suffering despite an early gain on good Chinese GDP.

Here is how the crash of the kiwi looks on the monthly NZD/USD chart. Note that the pair trading at the lowest levels since June 2010. The post crisis low of 0.6560 is the next support line. Below this line, its back to 2009.

Beforehand, support at 0.66 awaits.