Markets are slow, not moving much today. However, we suspect they will start rumbling later today when we have CAD and US CPI figures and also US Building Permits. Generally speaking, we see the USD in a stronger position than other currencies, so any moves against the buck are likely only temporary corrections.

On EURUSD below we are looking at short-term low near 1.0850 established yesterday where the pair might have completed a five wave decline from the July 10 highs. As such, the current rally is likely going to be structured in three waves, ideally a zigzag that can lift the pair back to the 1.1000-1.1080 area before the downtrend will continue next week.

EURUSD 1h Elliott Wave Analysis

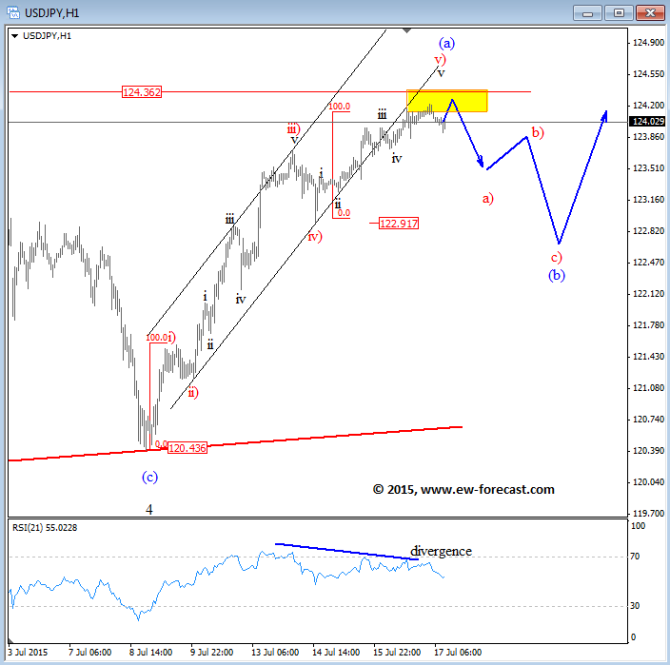

USDJPY is bullish, but still trying to find a resistance around the 124.00 area where a fifth wave may complete an impulsive wave (a), so traders must be aware of a deeper three wave set-back down in (b). A divergence on the RSI also suggests that upside is limited.

USDJPY 1h Elliott Wave Analysis