The Australian dollar had good reasons to rise last week, but this may not be the case now.

The team at Credit Agricole explains:

Here is their view, courtesy of eFXnews:

The AUD appreciated for most of last week, mainly in reaction to the RBA’s more comfortable stance with respect to the currency. The central bank refrained from calling the currency overvalued.

However, still muted growth momentum, confirmed by last week’s employment data, is likely to prevent rate expectations from rising. This is especially true as this week’s July business confidence data is unlikely to improve considerably due to still weak external demand conditions.

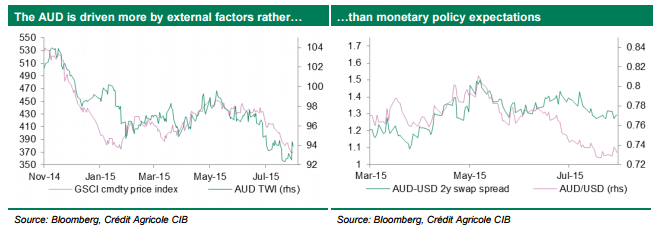

Elsewhere, we expect the currency to remain driven by external factors such as risk sentiment.Given a rising probability of the Fed tightening monetary policy in September, investors’ appetite for riskier assets is likely to deteriorate.

Any rise in cross market volatilities should keep the AUD subject to downside risk, in particular if commodity price developments slow further.

As a result of the above outlined conditions we advise against buying the currency around the current levels, in particular against the greenback.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.