The clock is ticking down towards the all important Fed decision.

Here is a last minute view from ING:

Here is their view, courtesy of eFXnews:

ING preferred scenario for today’s FOMC rate meeting sees the Fed refrain from a rate hike,manage expectations for an October hike, but deliver a benign outcome for risk assets with a suitably gradualist/dovish outlook.

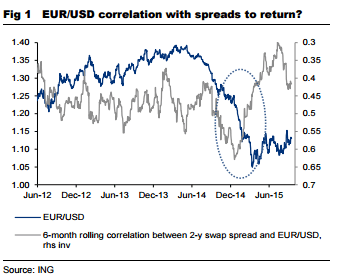

“This should generate a modest bearish flattening of the US yield curve. This curve move will have been a long time in coming and for many, including ourselves, has been the rationale for forecasts of a stronger dollar against the low yielding currencies,” ING argues.

“The dollar should outperform against the QE practitioners of JPY, EUR and we think now CHF as well. In short, we remain broadly positive on the dollar and retain a 1.05 EUR/USD target for year-end,” ING projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.