EUR/USD is dropping on the better market mood and already getting close to the pre-USD-sell-off levels. What’s next? Here is the view from JP Morgan:

Here is their view, courtesy of eFXnews:

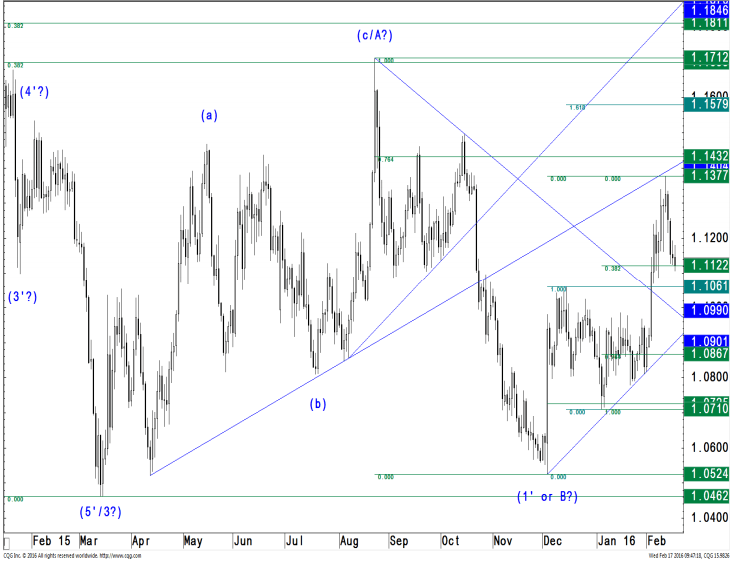

EUR/USD breakout of its short-term range between 1.1061 (Dec. 15 high = potential wave 1 top) and 1.1432 (minor 76.4 %) provides fresh directions, says JP Morgan.

EUR/USD break below 1.1061 eliminates the possibility of only dealing with a minor 4th wave setback and concludes that we are either dealing with a 2nd wave setback on higher scale to 1.0725/10 (int. 76.4 %/pivot) and possibly with the resumption of the long-term downtrend in case 1.0725/10 fails to provide support, notes JP Morgan.

Longer-term, JPM thinks that the failure of EUR/USD to clear key-resistance at 1.1420/32 (weekly breakout line/minor 76.4 %) last week leaves this market at risk of resuming its longterm downtrend to 1.0462 (2015 low) with the option to extend to 1.0072 (76.4 % of the 2000-2008 bull trend) and possibly to wave 3 projections at 0.9651 and at 0.9298.

“Only a decisive break above 1.1432 would re-open the upside for a re-test of the August 15 high at 1.1712 with the option to extend to the key-Tjunction on highest scale at 1.1811 (int. 38.2 % on highest scale).

Below 1.1432, the odds remain in favor of the long-term bears who are now expecting an internal 3rd wave decline to unfold which could potentially extend to 0.9455 (wave 1′ x 1.618),” JPM argues.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.