The New Zealand dollar felt the pressure initially but recovered quite quickly. Inflation expectations and milk prices are eyed now. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

The RBNZ is not in a rush to follow the RBA and cut rates, and this allowed the kiwi to recover. In the US, the greenback enjoyed strong retail sales and that stood out against the not-so-convincing sales in New Zealand.

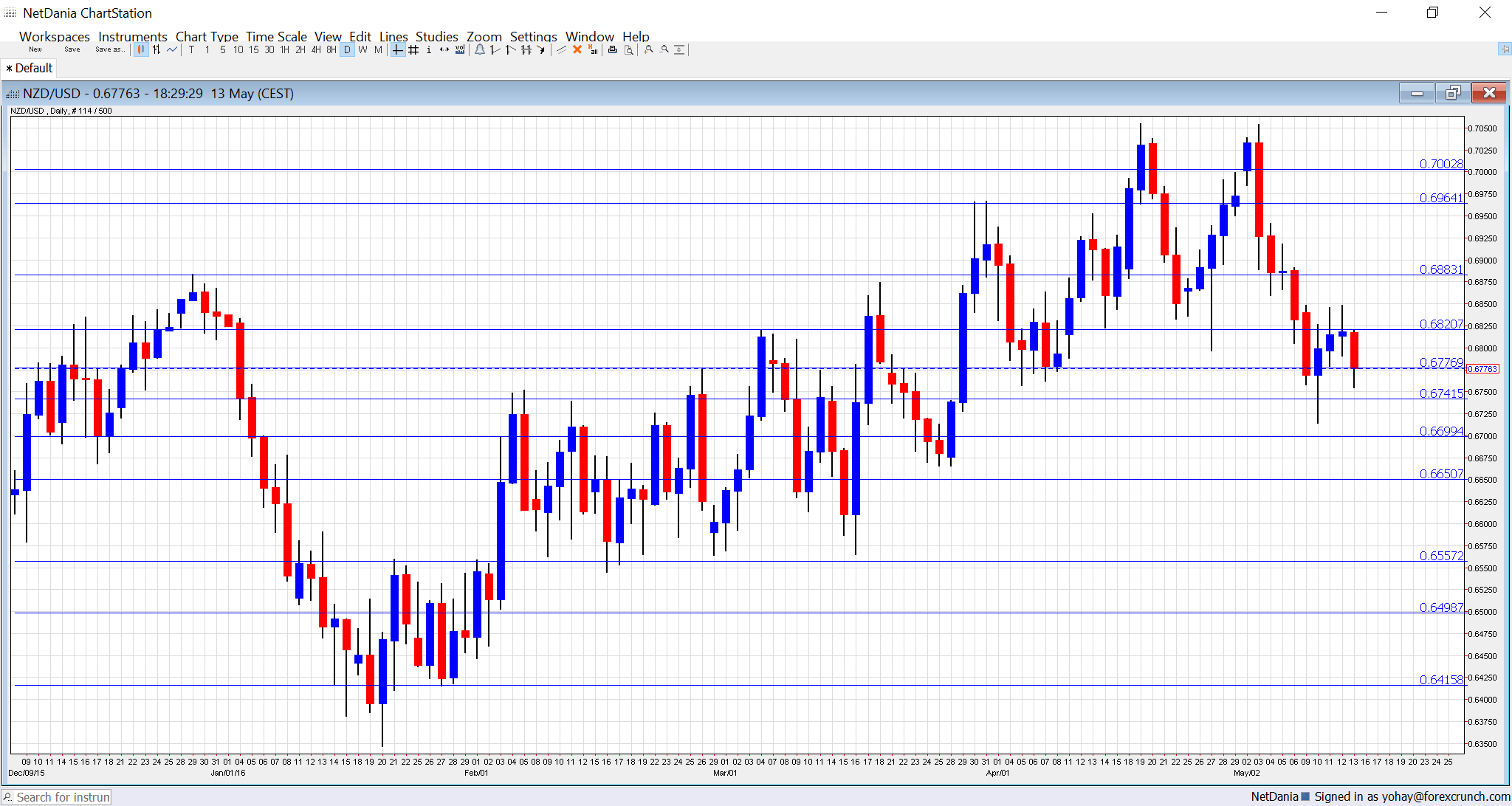

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Inflation Expectations: Tuesday, 3:00. With inflation figures published only once a quarter, this additional quarterly report provides more information and also serves as input for the RBNZ. After many quarters just around the 2% level, expectations fell to 1.6% in Q4 2015. Will it further fall now?

- GDT Price Index: Tuesday, during the European afternoon. Milk is New Zealand’s key export, making the Global Dairy Trade a very important bi-weekly publication. Prices dropped by 1.4% in the previous auction.

- PPI: Tuesday, 22:45. As with CPI, this is also a quarterly report. PPI Input, the main figure, dropped by 1.2% in Q4 2015. A bounce back worth 0.3% is on the cards now. PPI Output fell by 0.8%.

- Visitor Arrivals: Thursday, 22:45. The number of arrivals rose by 4.1% in March, the last month of the summer in New Zealand. A small drop could be seen now. Tourism also plays an important role in the economy.

- Credit Card Spending: Friday, 3:00. This time, the report comes out immeidately after the official retail sales report. Nevertheless, it will be eyed. A smaller rise of 4.8% was seen in March in comparison to previous months.

NZD/USD Technical Analysis

Kiwi/dollar felt the pressure and traded lower, but eventually got its act together and took a battle on the 0.6820 level.

Technical lines, from top to bottom:

0.7160 worked as support when the kiwi was trading on much higher ground in 2014. 0.7050 was the high in April 2015.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

The round 0.69 level has switched positions to resistance. 0.6860 was a low point as the pair dropped in June 2015. 0.6820 is worth noting after it capped the pair in March 2016.

It is followed by 0.6780 that capped the pair in recent months. The round level of 0.67 that works nicely as support. Another line worth noting is 0.6640, which capped the pair in November.

The post crisis low of 0.6560 is still of importance. Below, the round 0.65 level is of high importance now, serving as support.

I remain bearish on NZD/USD

Even without an imminent move, the RBNZ’s tendency is to the downside while the Fed is still talking about raising rates.

In our latest podcast we examine the upbeat US consumer and oil prices