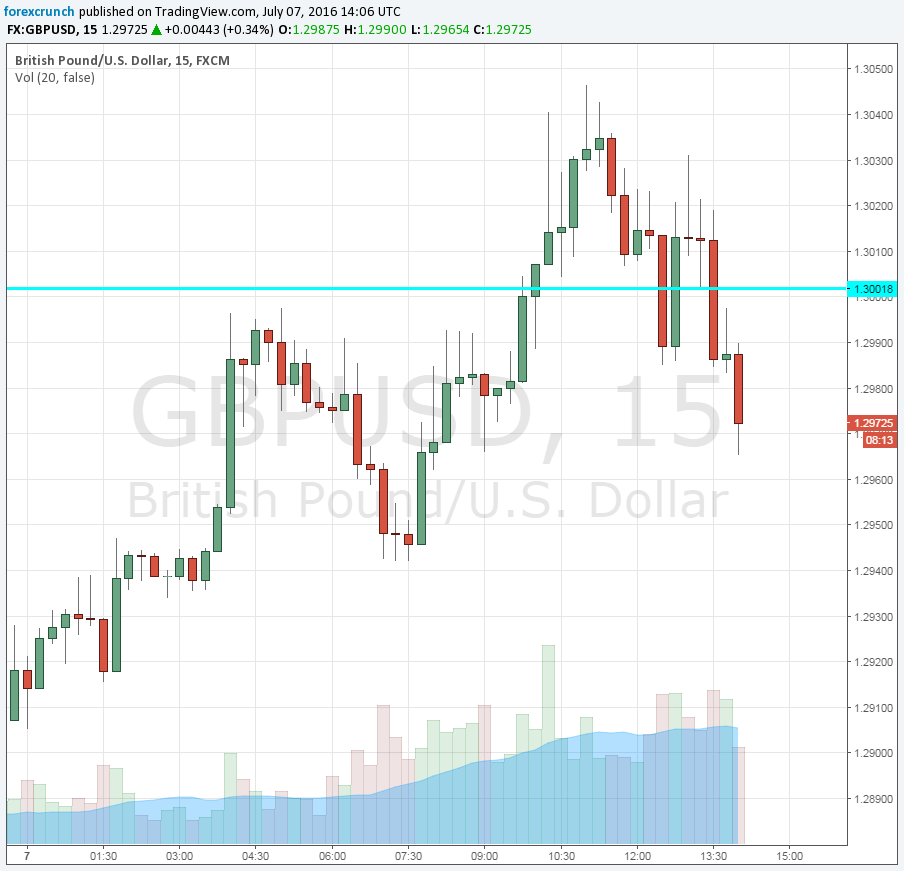

After tumbling down below 1.30 early on Wednesday, cable did managed to recover and climb above 1.30. The high was 1.3046, quite a significant 250+ pip recovery from the lows.

However, the pair is struggling to hold on to the round number, and there are good reasons to see it resume its falls and reach further 31 year lows. Here are 3 reasons the fall could continue:

- More construction worries: 6 companies announced a withdrawal freeze, all of them property funds. Another one joined today. We now hear of significant cuts in salutations coming from Legal and General, CCLA as well as Foreign and Colonial. This shows ongoing pressure on this sector.

- Darker forecasts: Mohammed el-Arian talked about GBP/USD reaching parity, especially if the BOE slashes interest rates. Christine Lagarde, IMF Managing Director urges the UK to get its act together and provide details about Brexit. The UK Tory party continues its process of choosing a new PM, but a new PM will be in place only on September 9th according to the current schedule. Without a new leader, it is hard to see decisions being taken.

- Strong NFP?: According to both the ADP and the ISM Non-Manufacturing PMI, we can expect a positive outcome from the US jobs report. This certainly does not guarantee a good outcome from the US, but the US economy is doing better than the UK one and even an OK result could be enough for the greenback to gain against the very vulnerable British pound.

More: Brexit – all the updates in one place

Here is the chart: