It was always hard to imagine helicopter money coming from Japan ahead of the US elections. That would not have looked too good. However, the visit of Ben Bernanke in Tokyo, as well as talk of stimulus, certainly supported the USD/JPY. The yen was falling

The yen was falling on hopes that the Bank of Japan would fund additional government investment. The scale that was mentioned was 10, 20 or even 30 trillion yen. The initial talk sent dollar/yen from the 100 handle to 105 and the higher numbers already propelled the pair to 107.50.

And now, the hot air comes out of the balloon. Reports from Tokyo talk about stimulus in the single digits of trillions. This is quite a disappointment.

In addition, it seems that expectations for significant stimulus from the BOJ is also fading out. The central bank releases its statement early on Friday, around 36 hours after the Fed. Many had expected Kuroda and co. to steal the show from the Fed. Well, they could share the disappointment.

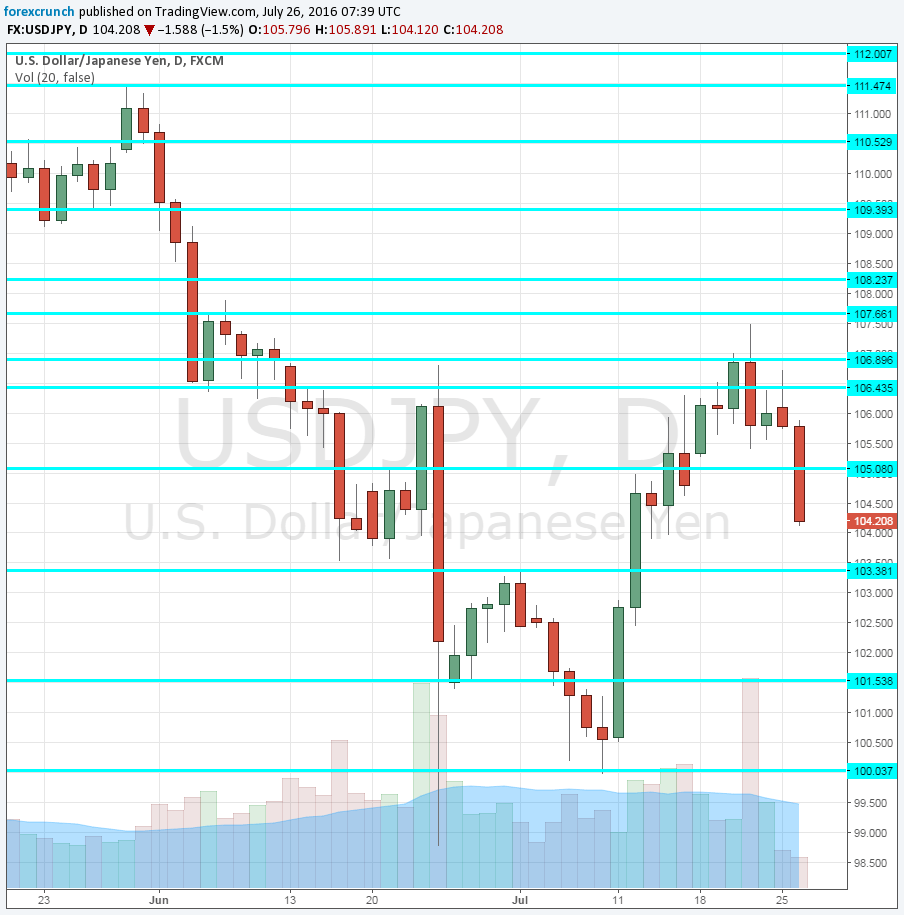

So, the outcome is quite a sharp fall in USD/JPY. The pair is down around 150 pips on the day, trading at 104.20 at the time of writing. 104.12 is the low so far.

Here is the daily chart of the pair. The next line of support awaits at 103.40, a line which provided support back in June, before Brexit. The next line is only 101.50. Resistance awaits at the round number of 105, followed by 107.65.

More: GBP/JPY Technicals: 138.75 bull/bear border