The Japanese government announced a new stimulus package worth 28 trillion yen. This came as no surprise to markets. They were already disappointed by the lack of helicopter money in Friday’s BOJ decision and the magnitude of the package was telegraphed ahead of the announcement.

So, we are seeing an extension of the downside trend in USD/JPY and a “buy the rumor, sell the fact” in play as well.

The package is worth around $275 billion US dollars but some of the components are loans and not direct investment. The Japanese government predicts that the measures will add a substantial 1.3% to growth, and that this will come relatively soon.

The huge stimulus package will be funded by issuing more bonds. In theory, more debt when the government is already indebted means more money printing by the central bank. And more money printing by the central bank should result in a weaker currency.

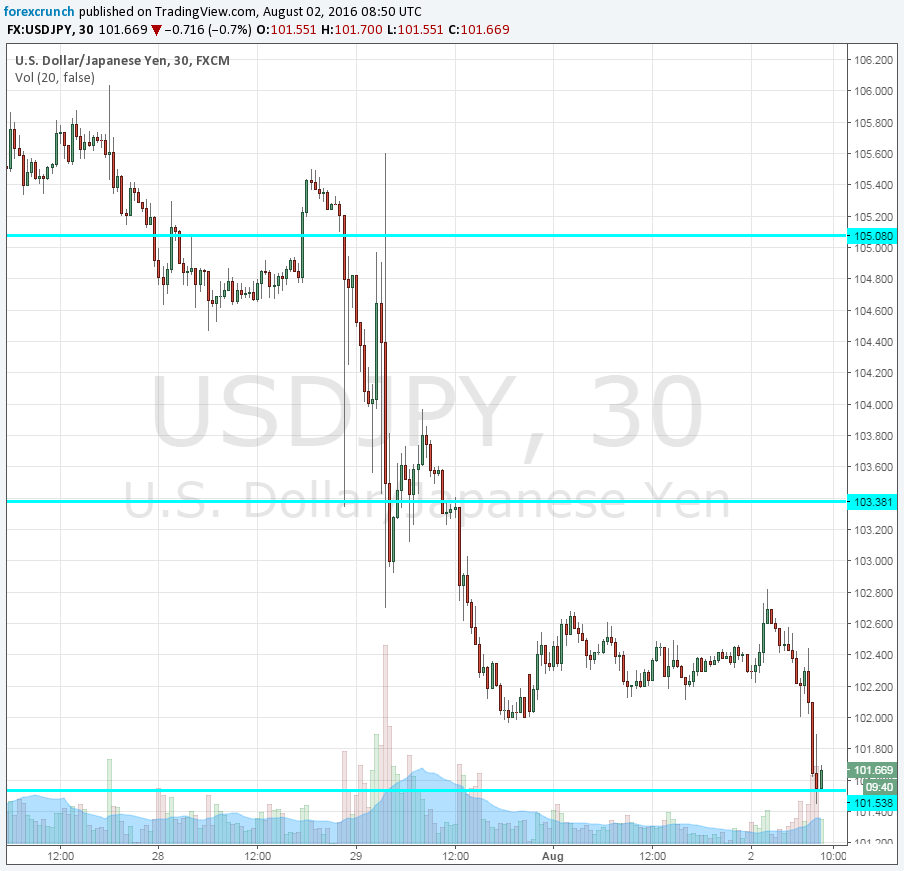

Well, given the high market expectations and the lack of outright debt monetization, the reaction is different. Dollar/yen is down to 101.70 at the time of writing, after having reached 101.45. The high of the day was 102.82.

As the chart shows, this is an ongoing trend. High hopes for a powerful fiscal and monetary one-two punch sent USD/JPY as high as 107.50 a few weeks ago. We are now gradually approaching the post-Brexit lows.

101.50 serves as support, followed by the round 100 level. 102.80 works as resistance.

More: USD/JPY to 100 and below – 3 post BOJ opinions