AUD/USD posted slight losses for a second straight week, as the pair closed at 0.7542. There are 10 events this week. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

In the US, new home sales beat expectations and durable goods reports also beat their estimates. On the other hand, GDP matched the forecast and Janet Yellen remained cautious in Jackson Hole. Anticipation is high ahead of a busy month that features both central banks making critical decisions.

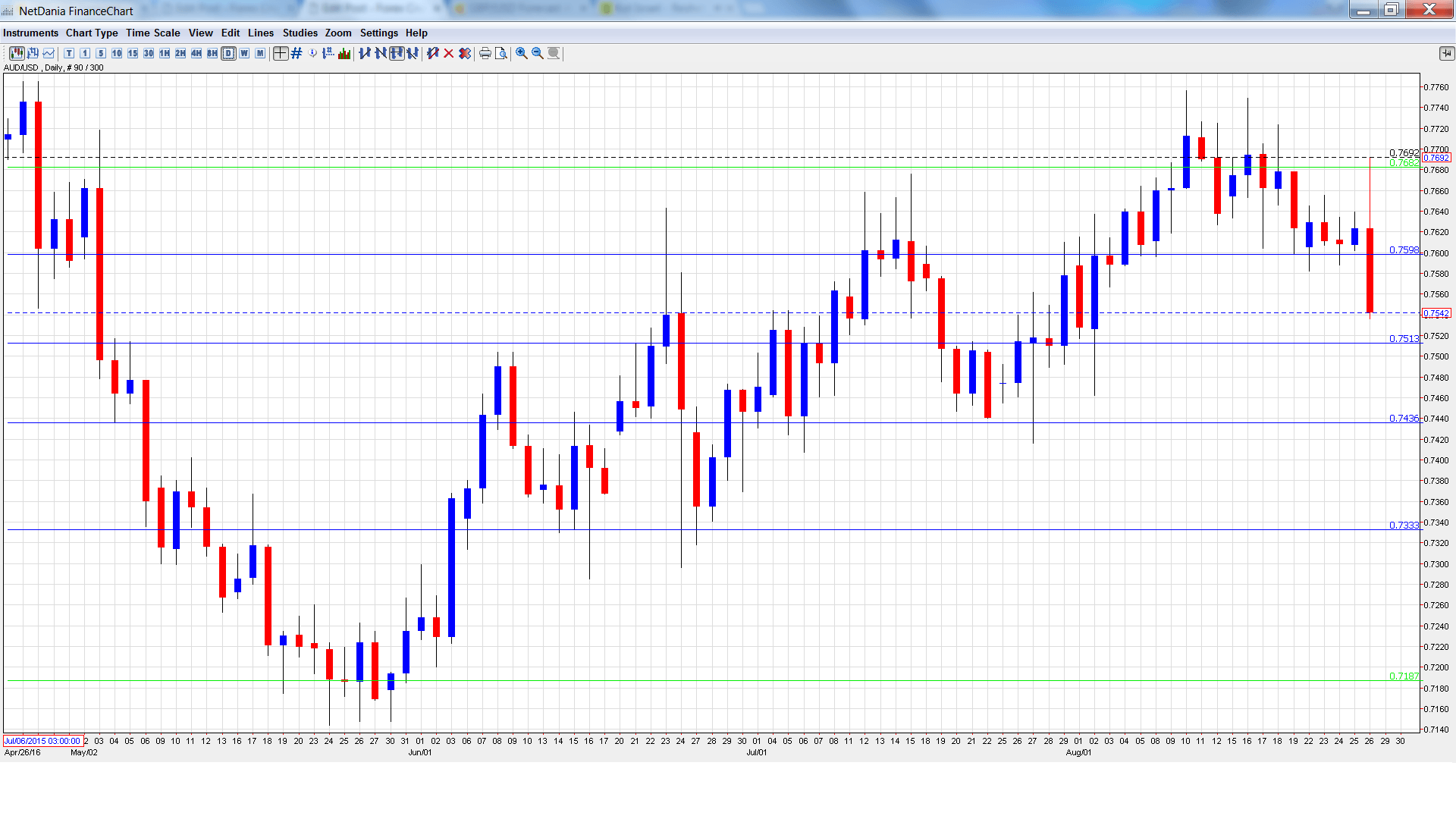

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- HIA New Home Sales: Monday, 1:00. This indicator provides a snapshot of the level of activity in the housing sector. The indicator rebounded in June, posting a sharp gain of 8.2%. Will we see another strong gain in July?

- Building Approvals: Tuesday, 1:30. The indicator tends to show strong volatility, making accurate predictions a tricky task. After two straight declines, the markets are expecting better news in the June report, with an estimate of 1.2%.

- RBA Assistant Governor Guy Debelle Speaks: Wednesday, 1:00. Debelle will speak at an FX conference in Singapore. A speech that is more hawkish than expected is bullish for the Australian dollar.

- Private Sector Credit: Wednesday, 1:30. The indicator dipped to 0.2% in the last release, shy of the forecast of 0.5%. The estimate for the upcoming release stands at 0.4%.

- AIG Manufacturing Index: Wednesday, 23:30. The index continues to post readings above the 50-point level, pointing to expansion in the manufacturing sector. In July, the indicator jumped to 56.4 points, its highest level since February.

- Chinese Manufacturing PMI: Thursday, 1:00. The PMI remains close to the 50-point level, which points to stagnation in the manufacturing sector. In July, the indicator came in at 49.9, close to the estimate of 50.1. Another reading of 49.9 points is expected in the August report.

- Private Capital Expenditure: Thursday, 1:30. This key indicator continues to struggle, posting five declines in the past six readings. The indicator posted a sharp decline of 5.2% in the first quarter, and a decline of 4.0% is expected in the second quarter.

- Retail Sales: Thursday, 1:30. Retail Sales is the primary gauge of consumer spending and should be treated as a market-mover. The indicator dipped to 0.1% in June, shy of the estimate of 0.3%. The estimate for the July report stands at 0.3%.

- Chinese Caixin Manufacturing PMI: Thursday, 1:45. The indicator improved to 50.6 points in July, above the forecast of 48.8 points. The estimate for the August release stands at 50.1 points.

- Commodity Prices: Thursday, 6:30. Commodity Prices continues to post declines, but there has been some improvement, with the July release coming in at -2.0%, the smallest decline since December 2013.

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7605. The pair had an uneventful week until Friday, when the pair climbed to a high of 0.7692. AUD/USD then reversed directions and dropped sharply to a low of 0.7536 late in the week, as support held firm at 0.7513 (discussed last week). AUD/USD closed the week at 0.7542.

Live chart of AUD/USD:

Technical lines from top to bottom:

We start with resistance at 0.8025.

0.7938 is next.

0.7835 has provided resistance since April.

0.7682 is next.

0.7597 is a weak resistance line.

0.7513 held firm in support as the pair posted sharp losses late in the week. This line was a cap in May and June.

0.7438 is next.

0.7334 was a cap in December 2015.

0.7192 is the final support level for now.

I am bearish on AUD/USD

The Fed is slightly less dovish than usual and a December hike is certainly on the table. Weak Australian numbers could raise speculation that the RBA will make another rate cut, and such sentiment could weigh on the Aussie.

Our latest podcast is titled Time to inflate inflation targeting and the suspicious oil rally

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.