USD/CAD posted small gains over the week, despite some strong movement in both directions. The pair closed the week at 1.3032. This week’s highlight is Manufacturing Sales. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

In the US, a major services report disappointed, as ISM Non-Manufacturing PMI sagged to 51.4 points, its worst showing since 2010. The Bank of Canada maintained the benchmark interest rate and Employment Change was much stronger than expected.

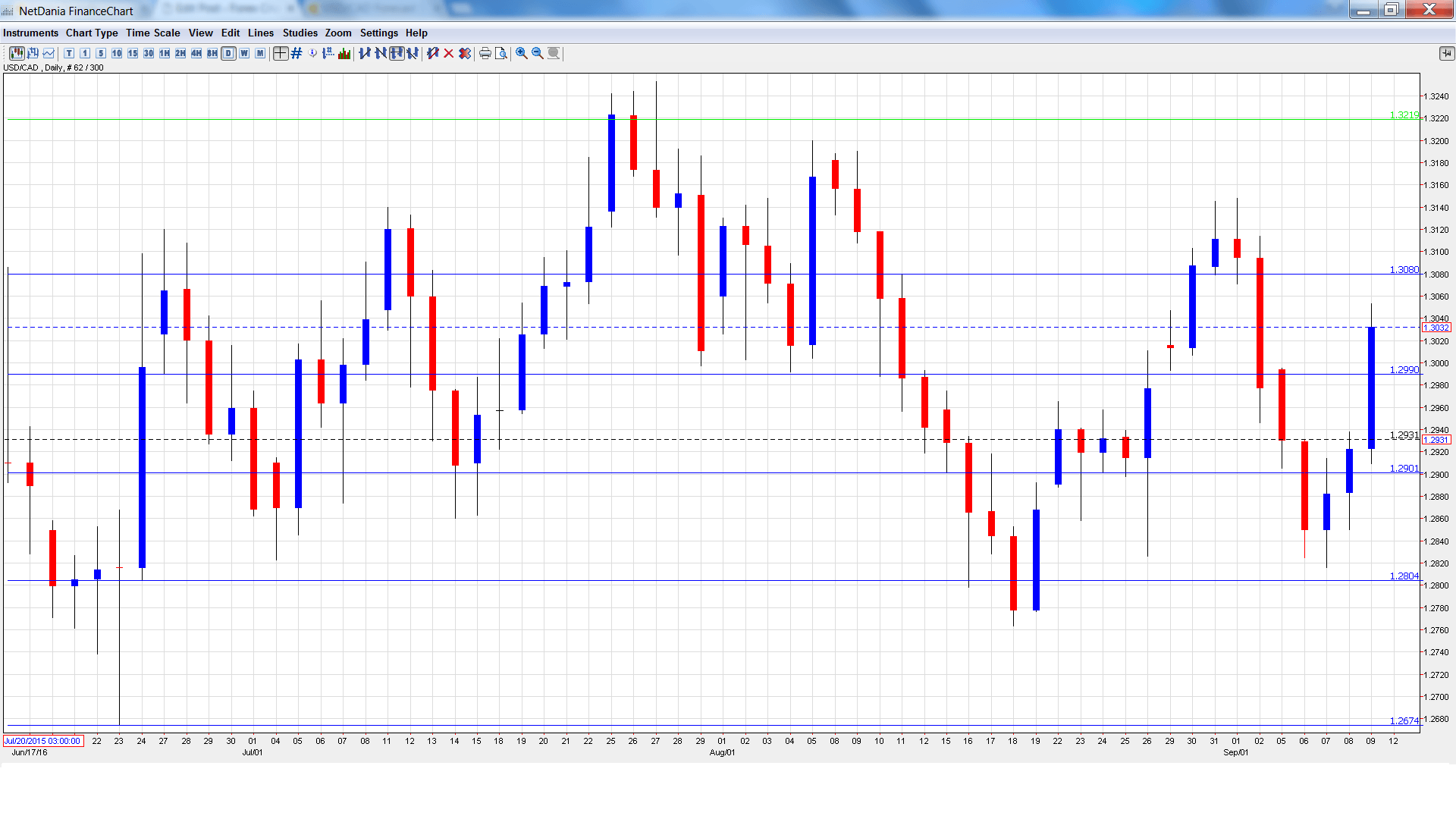

USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Governor Council Member Carolyn Wilkins Speaks: Wednesday, 10:30. Wilkins will speak at event in London, England. A speech which is more hawkish than expected is bullish for the USD/CAD.

- Manufacturing Sales: Friday, 12:30. This key event rebounded after a decline in June, posting a strong gain of 0.8%. This matched the forecast. The estimate for the July release stands at 0.6%.

- Foreign Securities Purchases: Friday, 12:30. The indicator is closely watched, as it is linked to currency demand. In June, the indicator dropped to C$9.02 billion, well short of C$17.23 billion. The forecast for the July estimate stands at C$10.12 billion.

USD/CAD opened the week at 1.2994. The pair dropped to a low of 1.2816, as support held at 1.2804 (discussed last week). USD/CAD then rebounded sharply and climbed to a high of 1.3053. The pair closed the week at 1.3032.

Live chart of USD/CAD:

Technical lines, from top to bottom

We start with resistance at 1.3353.

1.3219 was a cap in April.

1.3081 held firm in resistance as the pair posted sharp gains late in the week.

1.2990 is currently a weak support line.

The round number of 1.2900 is next.

1.2804 was an important cushion after the Brexit vote in late June.

1.2674 has provided support since mid-June.

1.2562 was a cap in July 2015. It is the final support line for now.

I am bullish on USD/CAD

Despite an excellent strong job report, the struggling Canadian dollar could not make headway against the US dollar last week. There is a reasonable chance that the Fed will raise rates in December, so sentiment towards the greenback remains positive.

Our latest podcast explains what really happens on jobs day.

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.