The New Zealand dollar made another attempt to the upside but eventually lost ground for a second week in a row. A lighter calendar will give some breathing room after both central banks made their calls Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

The Reserve Bank of New Zealand left the interest rate unchanged at 2% but provided more direct rhetoric against the strength of the currency, showing its frustration with the NZD’s recent move higher. Milk prices continued rising, and this contrasted the RBNZ’s message. In the US, the FED left rates unchanged but hinted that December is certainly on the cards. The initial reaction was a weaker dollar, but this did not last.

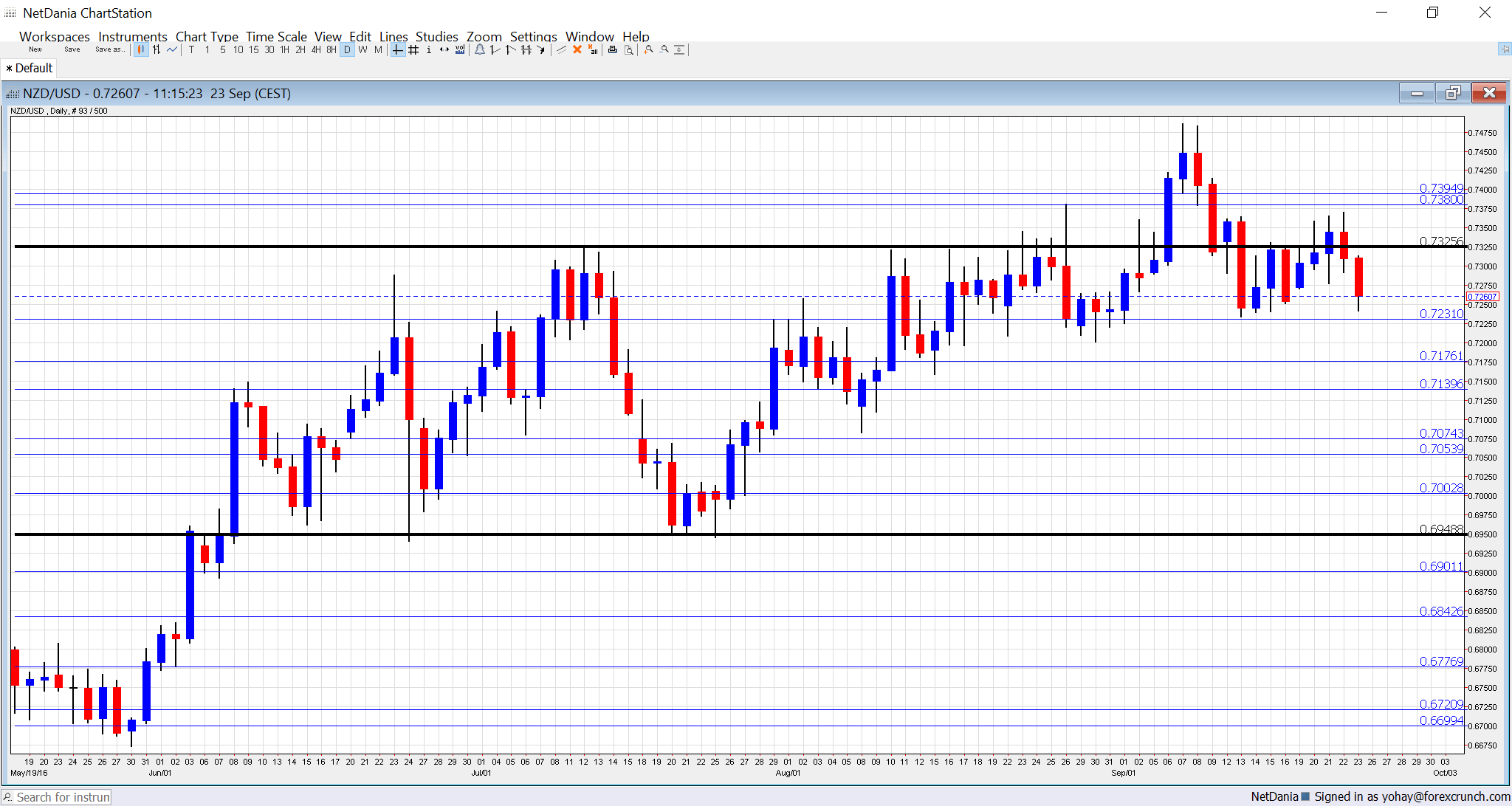

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Trade Balance: Sunday, 21:45. Just as markets wake up, we will see if New Zealand’s deficit in trade continues. The previous figure of -433 million was the first negative figure after 6 positive months.

- Building Consents: Thursday, 21:45. This gauge of the housing sector is very volatile, yet it still provides an insight. The number of approvals fell by 10.5% last month. It could bounce up now.

- ANZ Business Confidence: Friday, 00:00. This business barometer by ANZ, a major bank, has stabilized at 15.5 points last time, similar to 16 seen beforehand. A small rise may be seen now.

NZD/USD Technical Analysis

Kiwi/dollar made another attempt to the upside but could not reach 0.74 (mentioned last week) before dropping to lower ground.

Technical lines, from top to bottom:

0.7740 is the high watermark that capped the pair back in April 2015. It is followed by the round level of 0.76. 0.7460 is the high level seen in September 2016.

The round number of 0.74 served as resistance and support back in 2015. 0.7330 is the high of 2016 so far.

0.7290 was the pre-Brexit peak and serves as high resistance. The next line is 0.7240 which capped the pair in July 2016.

0.7160 worked as support when the kiwi was trading on the much higher ground in 2014. 0.7050 was the peak in April 2015.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

I remain bearish on NZD/USD

The RBNZ is clearly fighting the strength of the kiwi, and could win, thanks to the US dollar gaining further ground.

Our latest podcast is titled Bold BOJ vs. Fearful Fed