The first presidential debate between Hillary Clinton and Donald Trump saw rough exchanges and was eventually seen as a small victory for Clinton. But winning a debate does not necessarily imply gaining more support when it comes to voting intentions.

While we still don’t have all the possible polls, the first ones that are trickling in show growing support for the Democrat against the Republican.

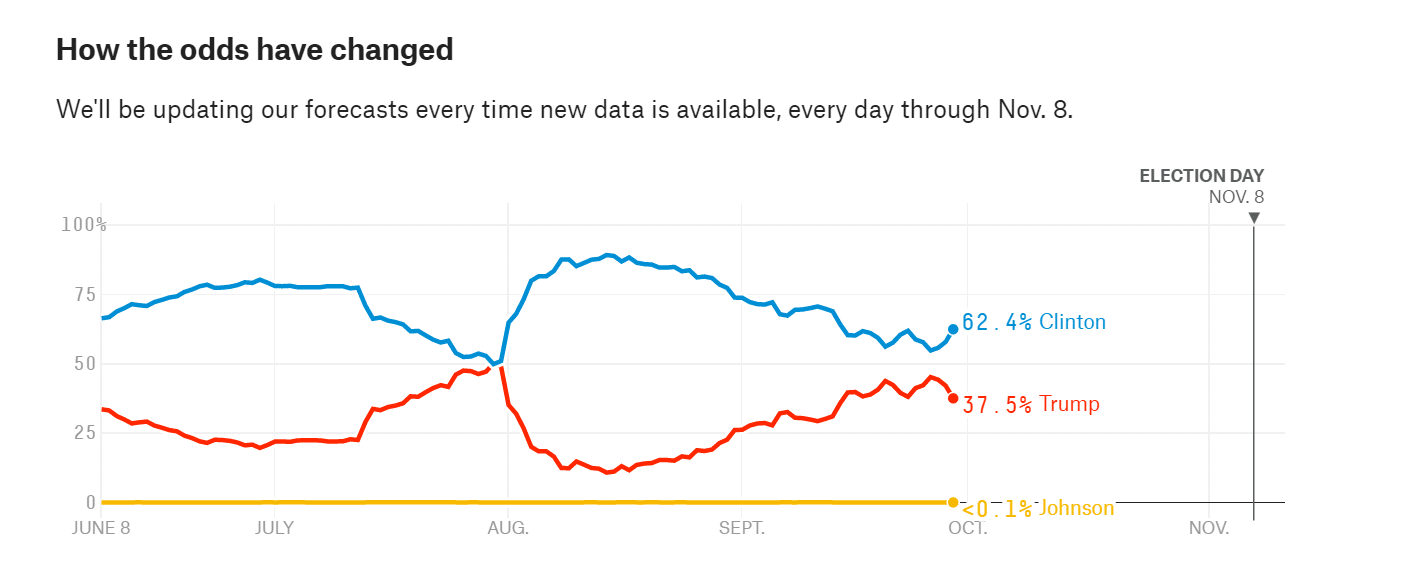

This measure of how the odds have changed show a widening of the gap towards Clinton, after long weeks of Trump closing in:

It was near 50/50 a few days ago and now Clinton has over 60% chance of winning. The state of Florida has moved to her column according to Nate Silver’s site that aggregates polls and analyzes them.

Needless to say, there is well over a month until the only vote that counts, and polls are not only correct if we remember Brexit not so long ago.

Markets usually prefer a pro-business, pro-market Republican, but Trump is no usual candidate and his stance is anti-trade. Clinton is a well-known mainstream candidate that is expected to deliver continuity.

In currency markets, the gainers from a Clinton victory are the Mexican Peso (MXN) as well as other risk currencies such as the Australian, New Zealand and Canadian dollars. The winners from a Trump victory are the safe haven yen and the Russian rouble, given Trump’s admiration of Russian President Vladimir Putin.

A better picture of the impact of the first debate should be seen by Monday. The VPs meet to debate on October 4th, while Trump and Clinton have a rematch on October 9th.

Markets are watching more closely.

More: Clinton Continuation vs. Donald Disruption – what the race means for currencies