AUD/USD reversed directions and lost 130 points last week, as the pair closed at 0.7539. This week’s highlights are the RBA minutes and Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

It was a tumultuous week in the markets, following Donald Trump’s stunning election win. The Australian dollar, a risk currency, took it on the chin as the US dollar posted broad gains. There were no major Australian indicators last week.

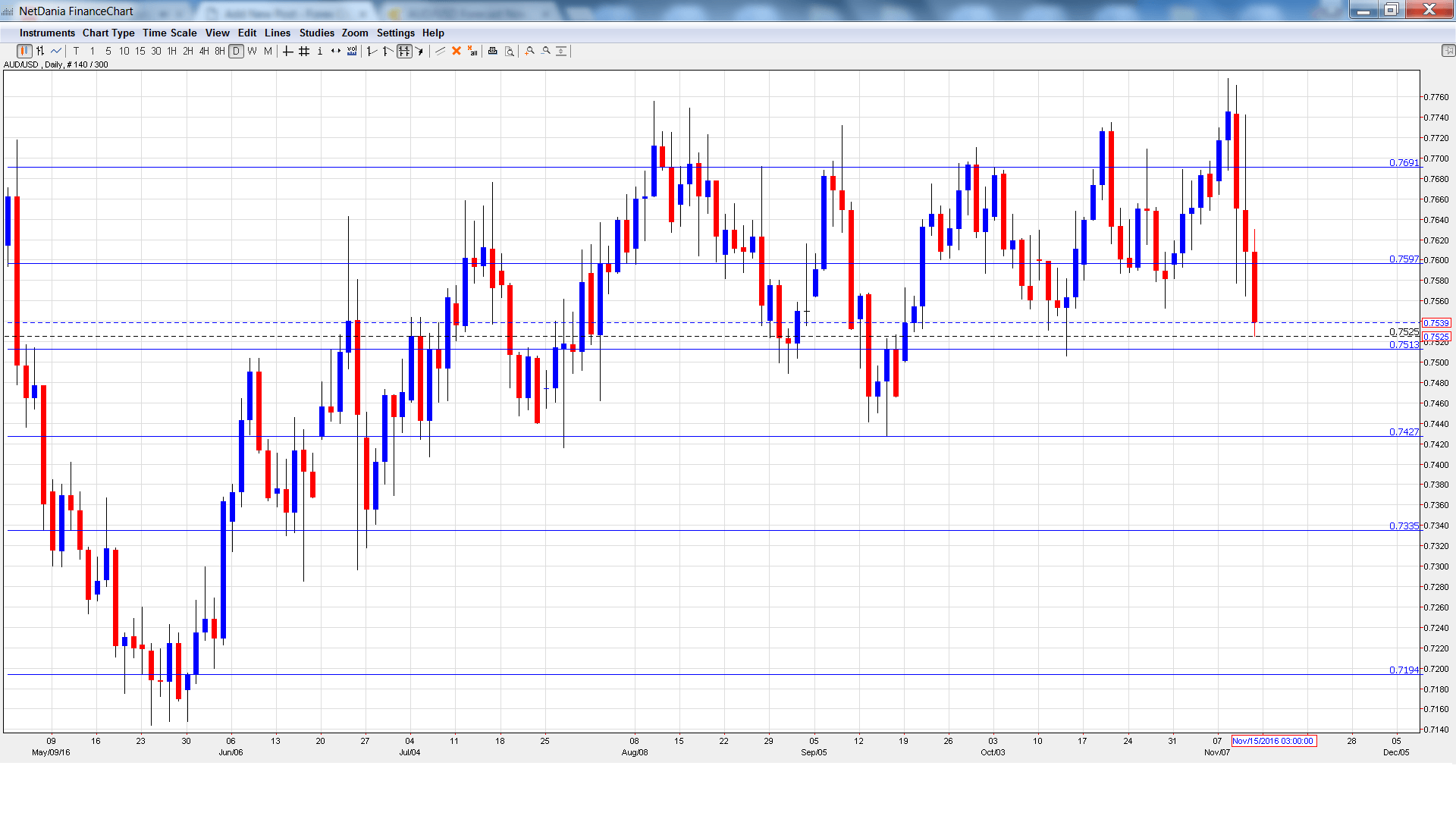

AUD/USD graph with support and resistance lines on it. Click to enlarge:

- Chinese Industrial Production: Monday, 2:00. Chinese indicators can have a significant impact on AUD/USD, as China is Australia’s number one trading partner. The indicator dipped to 6.1% in September, short of the forecast of 6.4%. The estimate for the October report stands at 6.2%.

- RBA Monetary Policy Meeting Minutes: Tuesday, 00:30. The minutes provides a detailed record of factors that made up the decision to hold rates at 1.50% at the last policy meeting.

- RBA Governor Philip Lowe Speech: Tuesday, 8:15. Lowe will speak at an event in Melbourne. A speech which is more hawkish than expected is bullish for the Australian dollar.

- MI Leading Index: Tuesday, 23:30. The minor indicator remains at low levels. In September, the indicator posted a small gain of 0.1%.

- Wage Price Index: Wednesday, 00:30. This quarterly indicator is an important employment indicator. In the second quarter, the indicator gained 0.5%, matching the forecast. The forecast for the third quarter remains unchanged at 0.5%.

- Employment Change: Thursday, 00:30. This key indicator posted losses in the past two months, well short of the estimates. The markets are expecting a strong turnaround in the October report, with an estimate of 20.3 thousand. Will the indicator match or beat the rosy forecast?

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7677 and climbed to a high of of 0.7778. It was all downhill from there, as the pair dropped to a low of 0.7525, as support held firm at 0.7513 (discussed last week). AUD/USD closed the week at 0.7539.

Live chart of AUD/USD:

Technical lines from top to bottom:

We begin with resistance at 0.7938.

0.7835 has held firm since April.

0.7691 was a cap for much of October.

0.7597 has switched to a resistance role after losses by AUD/USD.

0.7513 is a weak support level.

0.7427 marked the low point for the month of September.

0.7334 was a cap in December 2015.

0.7194 is next.

0.7105 is the final support level for now.

I remain bearish on AUD/USD

The US dollar posted broad gains after the Trump shocker and could continue to rack up goals against the Aussie. At the same time, a strong Australian employment report could blunt gains by the greenback.

Our latest podcast is titled Trump-time – fiscal, monetary and market implications

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.