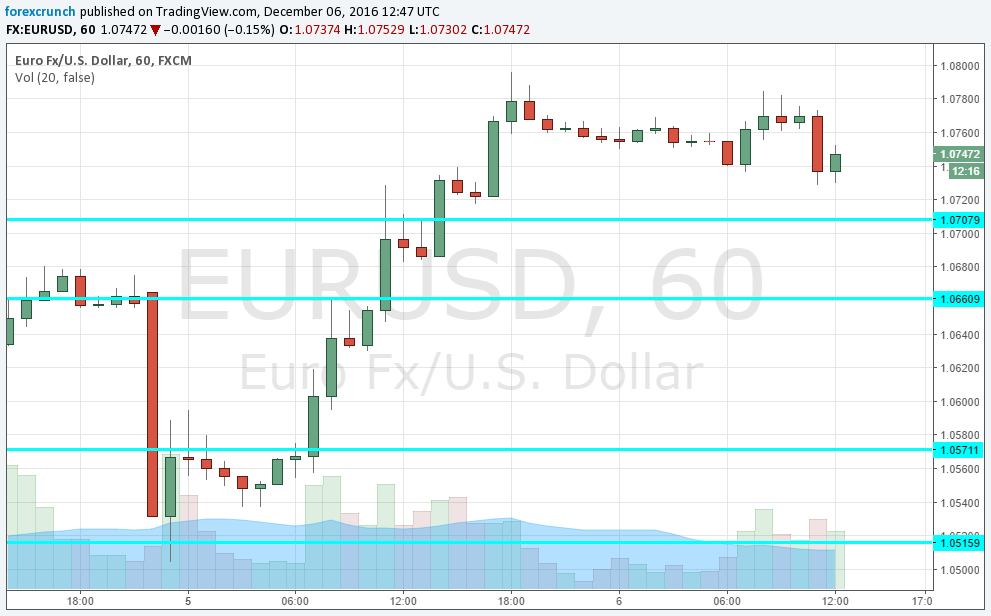

EUR/USD had an impressive rally from the lows: the outcome of the Italian Referendum was not really a surprise, and we said in our preview: there was only upside for the euro.

From falling to 1.0510, the pair nearly touched 1.08. However, things never stay in place for too long.

PM Renzi resigned, also not a surprise given his pre-poll pledge. But the consequences could now seem worse. Instead of a new government being formed by one of his colleagues in parliament or a caretaker technocratic government, Italians could go to the polls once again: for general elections.

According to reports in the Italian press, an early election in February could be the outcome of the “Renzirendum.” The anti-establishment left-wing 5-Star Movement is in the lead according to opinion polls, and could take Italy to a eurosceptic direction. This is far from certain, but elections in two months time would be the worst scenario. For some troubled Italian banks, elections would add to growing uncertainty.

In addition, another Italian will soon take center stage: Mario Draghi. The President of the ECB is due to deliver the results of the rate decision and will probably announce an extension of the Bank’s QE program. Markets are already pricing in a 6-month extension. Even if Mario just meets market expectations, it would still serve as a weight on the common currency’s shoulders.

EUR/USD is currently trading at 1.0747, off the near 1.08 highs. Support awaits at the veteran line of 1.0710, followed by 1.0690.

More: Trading the ECB with EUR/USD