The Canadian dollar continues to improve, as USD/CAD dropped 270 points for a second straight week. This week is quiet, with only three indicators. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

In the US, key economic indicators continue to impress. ISM Non-Manufacturing PMI beat expectations and UoM Consumer Sentiment jumped and easily beating the estimate. In Canada, the BoC kept rates at 0.50% and Building Permits sparkled with a gain of 8.7%.

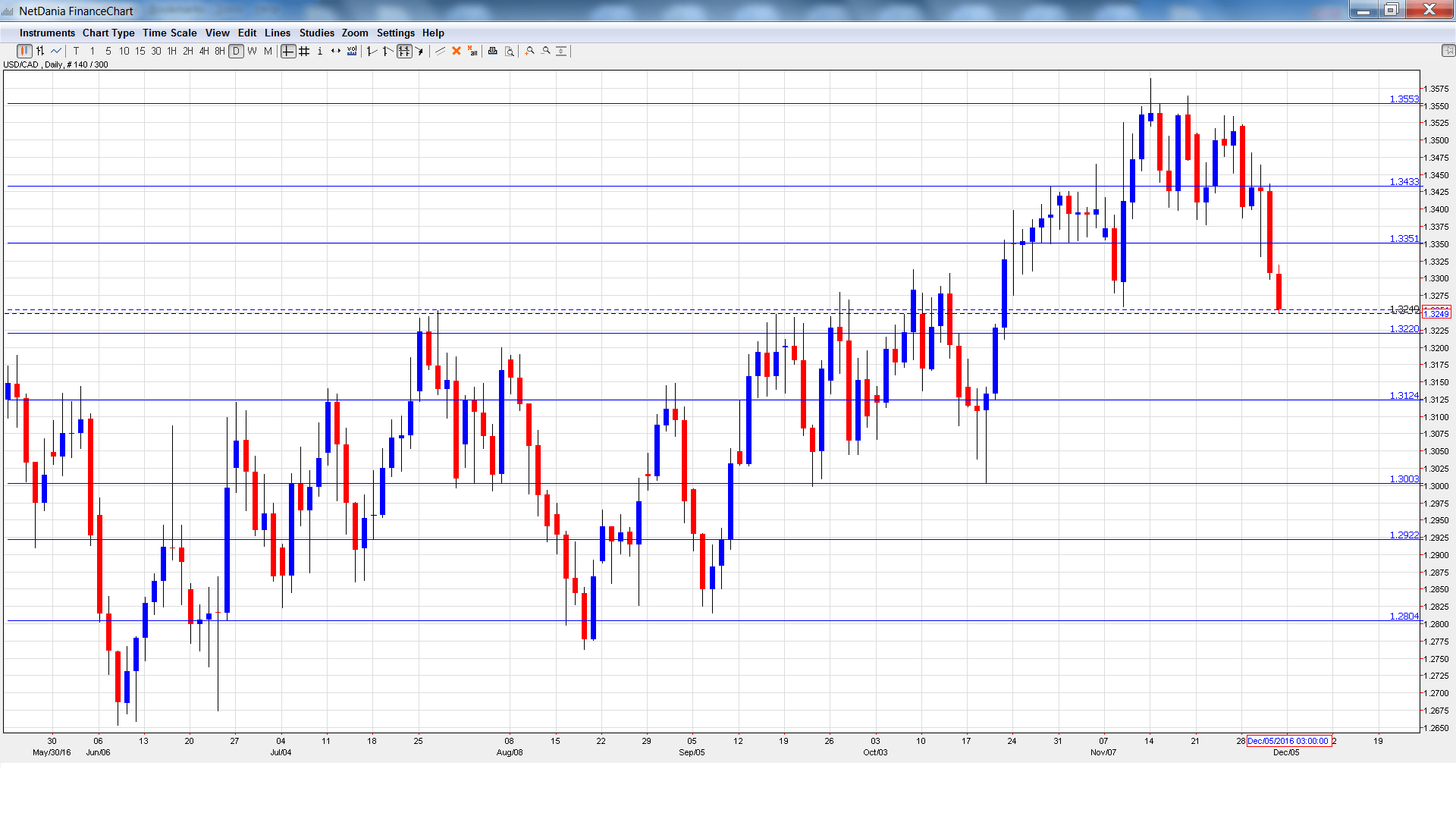

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Manufacturing Sales: Thursday, 13:30. The week starts with this key indicator. In September, Manufacturing Sales slipped to 0.3%, but this beat the estimate of -0.2%. The markets are expecting a stronger gain of 0.7% in October.

- BoC Financial System Review: Thursday, 15:30. This minor release is released twice a year. Analysts will be combing through the report, looking for insights into future monetary policy. BoC Governor Stephen Poloz will follow up with a press conference.

- Foreign Securities Purchases: Friday, 13:30. This indicator is closely linked to currency demand. The indicator dipped to C$11.77 billion, short of the estimate of C$12.23 billion. The indicator is expected to climb to C$12.35 billion.

USD/CAD opened the week at 1.3326 and quickly touched a high of 1.3349. The pair then reversed directions, sliding to a low of 1.3148, as support held firm at 1.3124 (discussed last week). USD/CAD closed the week at the round number of 1.3153.

Live chart of USD/CAD:

Technical lines, from top to bottom

We start with resistance at 1.3551.

1.3433 was the high point in October.

1.3351 is next.

1.3219 is an immediate resistance line.

1.3124 is a weak support line which could break this week.

1.3003 is protecting the symbolic 1.30 level. It was last tested in mid-October.

1.2922 is next.

1.2804 is the final support line for now.

I am neutral on USD/CAD

The Canadian dollar has rebounded sharply thanks to stronger oil prices. With OPEC and non-OPEC countries signing a deal on Saturday, this currency could continue to move upwards. Meanwhile, the Fed will likely raise rates this week for the first time since December, so the greenback could get a boost.

Our latest podcast is titled From the Crude Cut to Draghi’s Drag

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.