US consumers are more upbeat: the consumer confidence measure beat expectations with 98 points. The Conditions component also surprised with 112.1 and the Expectations one came out at 88.9, above expectations. 1-year inflation expectations are down to 2.3%, 5-year to 2.5%. Wholesale sales beat with 1.4%. The critical data is above expectations.

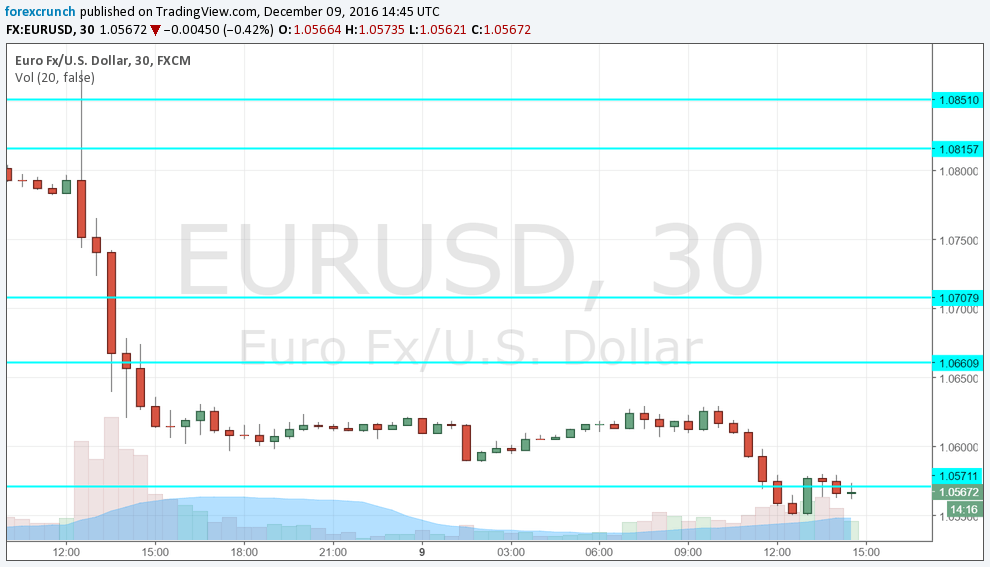

The US dollar looks strong, with EUR/USD battling 1.0550.

The preliminary read on US consumer sentiment for December was expected to stand at 94.5 points. The University of Michigan reported a score of 93.8 points back in November. Here is our preview: trading the consumer confidence with EUR/USD. The conditions component was predicted to rise from 107.3 to 108.5 points. The Expectations one was also projected to rise from 85.2 to 87. The inflation expectations measured are also eyed. Wholesale Sales were forecast to rise 0.5% after 0.2% seen beforehand, in a separate publication.

The US dollar was looking good ahead of the publication. EUR/USD traded around 1.0570, extending the losses that resulted from Draghi’s dovishness.

Here is how EUR/USD looks after the big fall.