GBP/USD continued to slide, as the pair fell for a third straight week, losing 210 points. GBP/USD closed at 1.2278, its lowest weekly close since late October. There are only three events this week. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD.

In the US, GDP third quarter growth beat expectations with an excellent reading of 3.5% but durable goods orders were mixed. Consumer confidence also looked sharp, rising for a second straight month. In the UK, Final GDP came in at 0.6%, above the forecast of 0.5%.

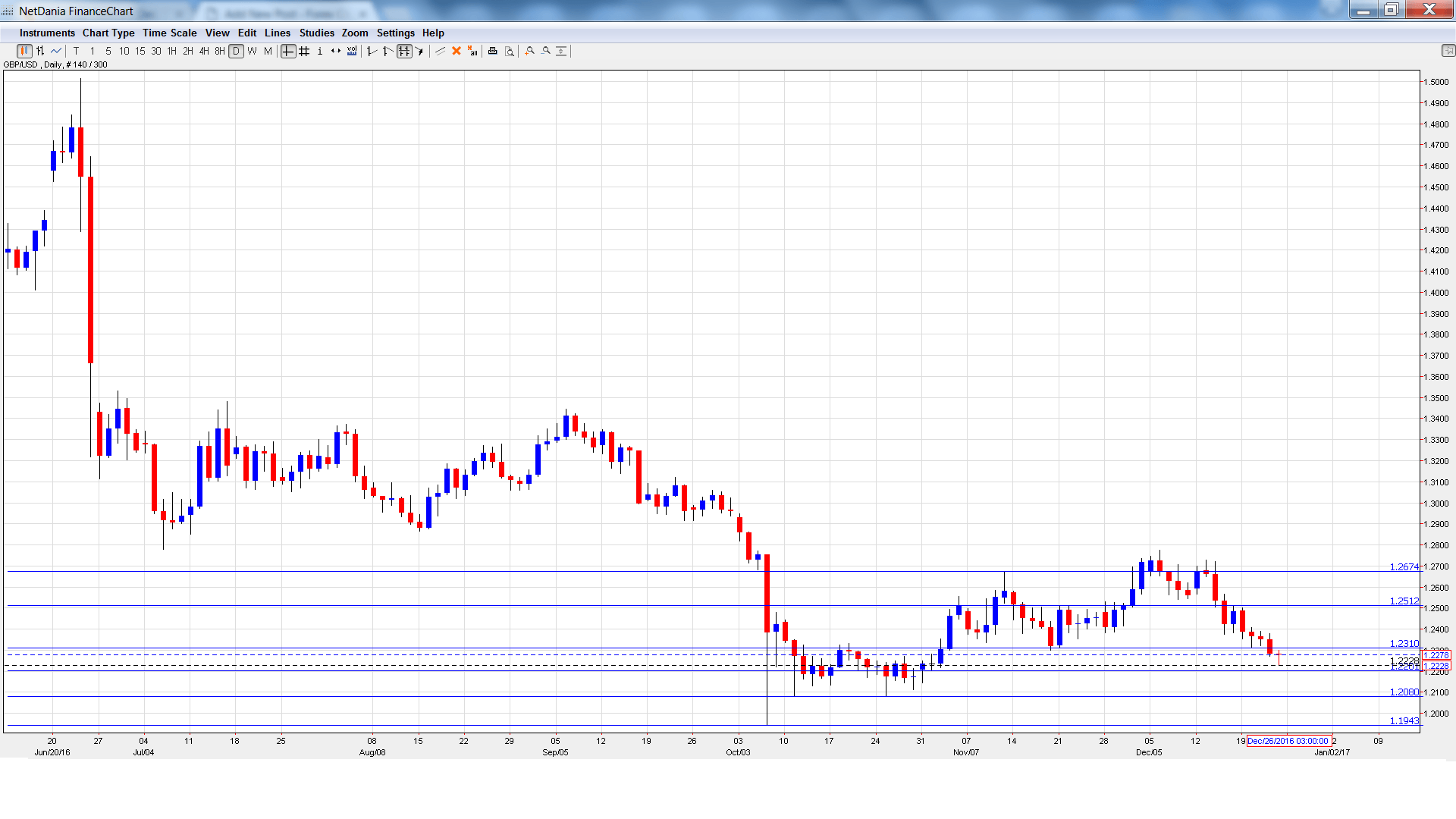

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- BBA Mortgage Approvals: Wednesday, 9:30. The indicator improved to 40.9 thousand in October, above the forecast of 38.8 thousand. The upswing is expected to continue in November, with an estimate of 41.6 thousand.

- Nationwide HPI: Thursday, 7:00. In November, the index edged up to 0.1%, shy of the forecast of 0.2%. The estimate for the December report stands at 0.2%.

- Housing Equity Withdrawal: Friday, 9:30. The indicator showed an upsurge in loans in Q2, with a reading of GBP -12.6 billion. This was much higher than the estimate of GBP -5.4 billion. The estimate for Q3 is GBP -11.1 billion.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.2487 and quickly climbed to a high of 1.2502, as resistance held at 1.2512 (discussed last week). It was all downhill from there, as the pair dropped to a low of 1.2228. GBP/USD closed the week at 1.2278.

Live chart of GBP/USD:

Technical lines from top to bottom

With GBP/USD posting sharp losses, we begin at lower levels:

1.2674 was a cap in November.

1.2512 was tested in resistance early in the week before the pair posted sharp losses.

1.2311 has switched to a support role. It is an immediate line.

1.2201 follows in support.

1.2080 is protecting the symbolic 1.20 level.

1.1943 is the final support line for now.

I am neutral on GBP/USD.

Trading volumes are usually light the week of Christmas and there are only a handful of major events on the calendar. So, we’re unlikely to see any significant move from the pair.

Our latest podcast is titled What will move markets in 2017

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.