Slightly stronger confidence among consumers: the UoM measure is up to 97.6 points. The Conditions component is at 114.5 points and the Expectations at 86.7. All are just above early projections. The inflation sub-components are slightly weaker, with 2.4% for one year and 2.2% for five years.

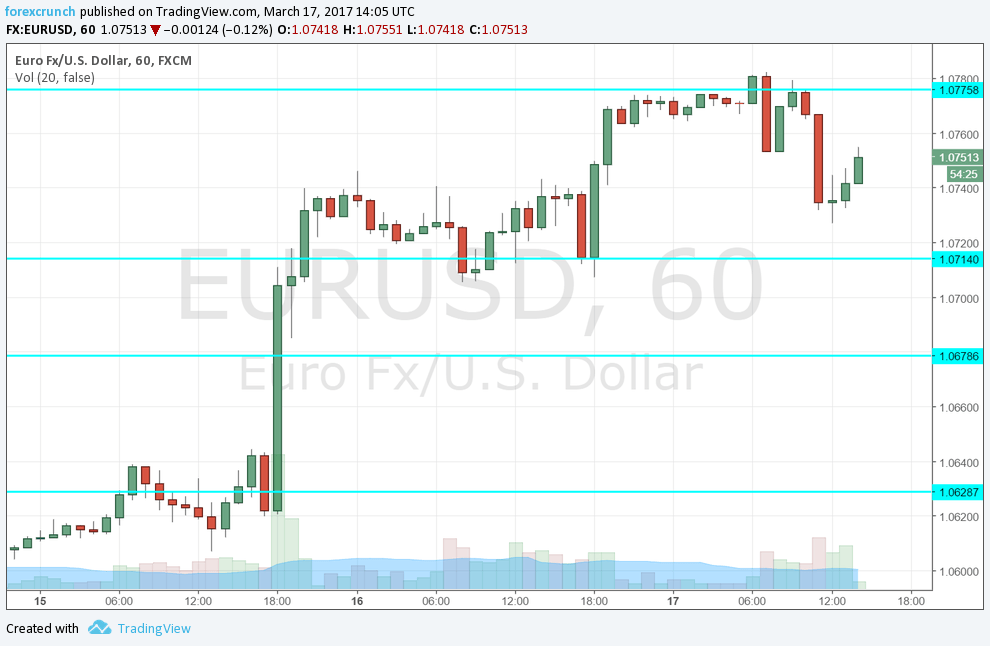

EUR/USD is actually rising in the aftermath. The trend goes against the dollar.

Earlier, US industrial output remained flat against expectations for an increase of 0.2%, but with an upwards revision. This is a second-tier figure in a developed economy that has long shifted away to services.

The US consumer sentiment according to the University of Michigan was expected to advance to 97 points in March in the initial read after 95.7 in February.

Here is the preview: trading the consumer sentiment with EUR/USD

The US dollar was making attempts to recover from the blow it received from the Fed’s dovish hike. Here are 5 dollar downers.

EUR/USD was also somewhat lower, despite a boost from the ECB.