The manufacturing sector in the UK has grown at a slower pace in March, according to Markit. The purchasing managers’ index dropped to 54.2 from 54.5 and more significantly, short of the 55.1 points expected.

It was not supposed to be this way. The EU Referendum sent the pound tumbling down. In turn, the weaker exchange rate resulted in improved terms of trade for British manufacturers. Exports are now cheaper in foreign currency than they used to be before the June 23rd vote. With a competitive advantage, optimism was predicted to rise within those surveyed by Markit.

Nevertheless, the indicator is lower. Brexit is probably painful as well. In addition, some manufacturers need to import some raw materials from abroad in order to produce their finished goods.

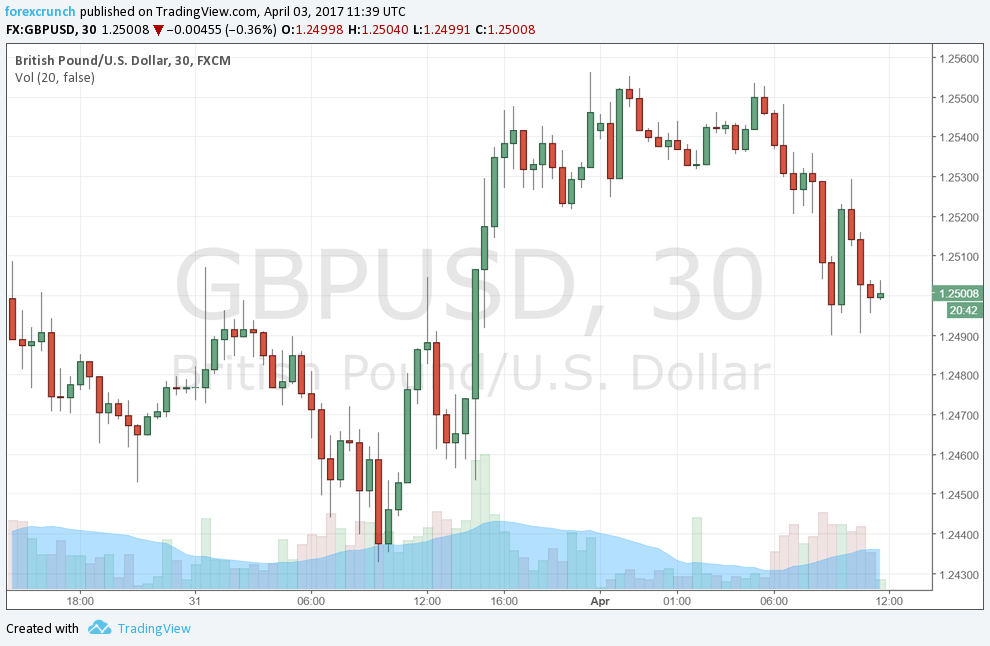

GBP/USD did not like it too much. The pair was trading around 1.2550 and dropped below 1.25. The low, for now, is 1.2490. Support awaits only at 1.2415.

The depreciation comes on the background of a stable US dollar across

Will the pound continue falling?

More:

- GBP: ‘Uncertainty Has Only Just Begun’; Get Ready To Buy The Dip – BofA Merrill

- GBP: The Potential For Further Squeeze Higher Is ‘Ever-Present’ – NAB