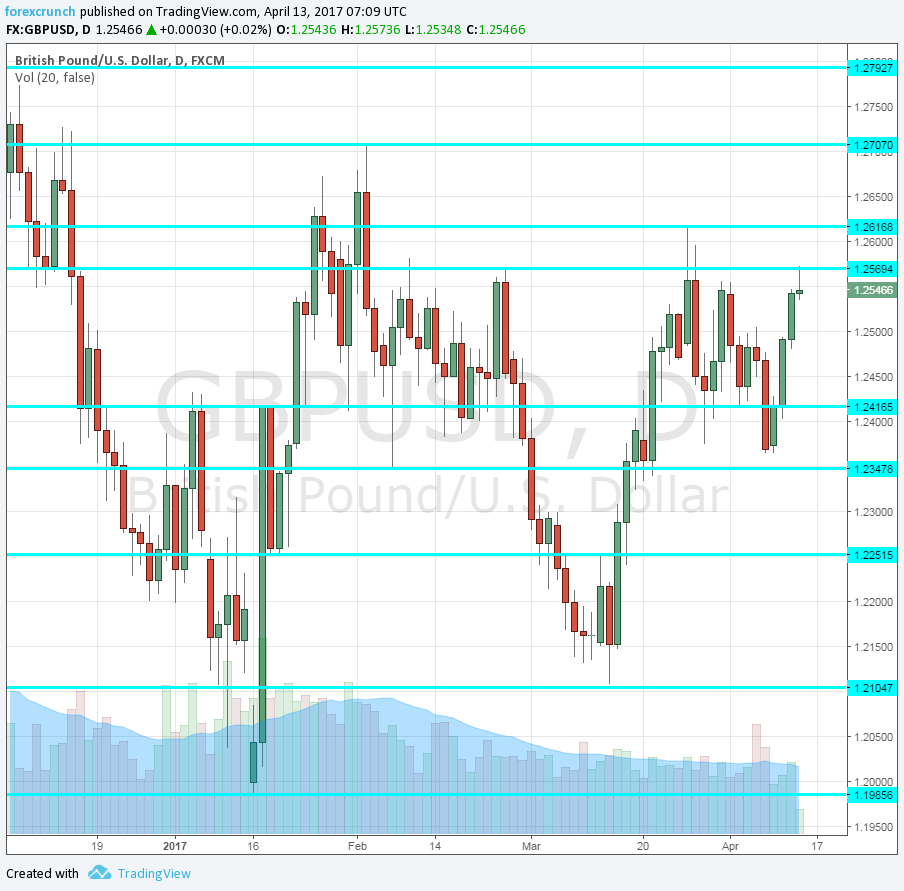

GBP/USD is trading on higher ground thanks to the Trump Tumble but the move is somewhat limited. The pair has been rejected at 1.2565, the February 24th swing high. Cable’s technical behavior is quite impressive.

So if the US dollar is falling because of Trump’s talk about the dollar being too strong, what is limiting the pound? Other currencies have rallied hard against the greenback.

Inflation erodes wages, Brits buying essentials

Data released earlier this week may be detrimental. The UK jobs report showed a worrying gain of 25.5K in jobless claims during March, but markets were cheering the yearly rise of 2.3% in average earnings in February, beating expectations of 2.1%.

But the rise of 2.3% wages is only enough to balance out the rise in inflation: 2.3% y/y in January and also in February. So, Brits are not enjoying a real rise in living standards.

Worse off, details emerging from shopping patterns as well as price rises shows a concerning trend: consumers are finding themselves spending more on essentials such as food and energy as their prices rise and they are scaling back on non-essentials. Those that are “just about managing” are struggling a bit more.

GBP/USD levels

Pound/dollar is currently at 1.2545 after backing down from resistance. Support awaits at 1.2415, which was the bottom of the trading ranges earlier this year. Further support is at 1.2350.

Resistance awaits at 1.2620, followed by 1.27.