France has been at the center of attention due to the presidential elections, but it also has a data flow. The second-largest economy in the eurozone reported a growth rate of 0.3% q/q, under 0.4% expected. In addition, year over year growth posts a similar shortcoming: 0.8% instead of 0.9% predicted.

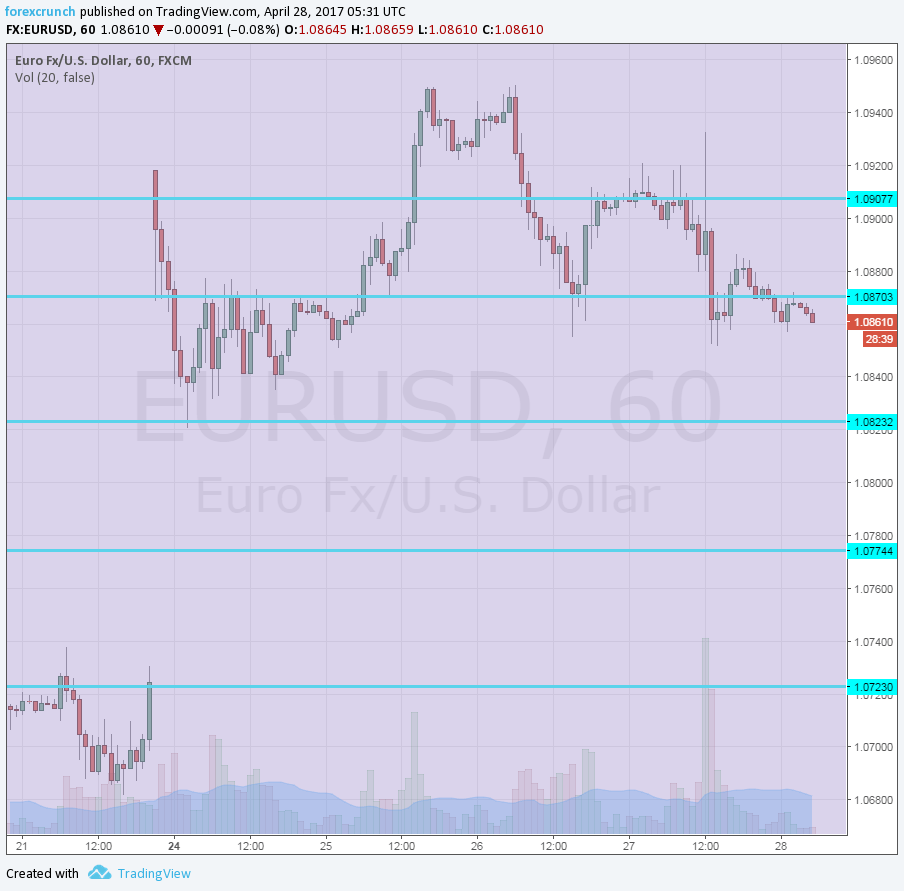

EUR/USD remains stable closer to the lower end of the range, but loses some ground on the outcome, a slide of a few pips.

And what about the elections? We are five days after Macron topped the polls in the first round. Markets are optimistic about his lead in the second round against extremist Marine Le Pen. The IFOP poll has been quite stable with a 21% lead: 60.5% to 39.5%.

The Opinionway daily poll did show some slippage: an 18% gap: 59% to 41%. The gap narrowed from 64% to 36% before the first round. Should we worry? Not so fast. If the trend continues and Le Pen gains momentum, markets could become jittery.

Yesterday’s big event was the ECB meeting. It began with “diminishing downside risks”, a phrase that pushed the euro higher. Later on, Draghi mentioned the lack of conviction on inflation and no discussion on an exit strategy. The euro dropped.

The big event today is the first release of US GDP. See how to trade the US GDP with EUR/USD.